Question: Using Chryslers data, compute r 1 , the correlation coefficient between e t and e t-1 , for the error terms computed in Chryslers regression

Using Chrysler’s data, compute r1, the correlation coefficient between et and et-1, for the error terms computed in Chrysler’s regression model.

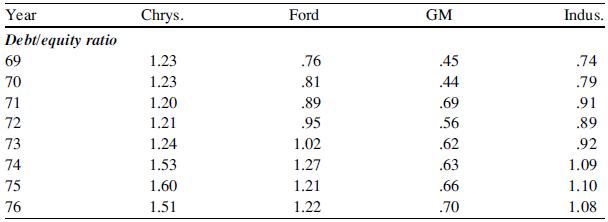

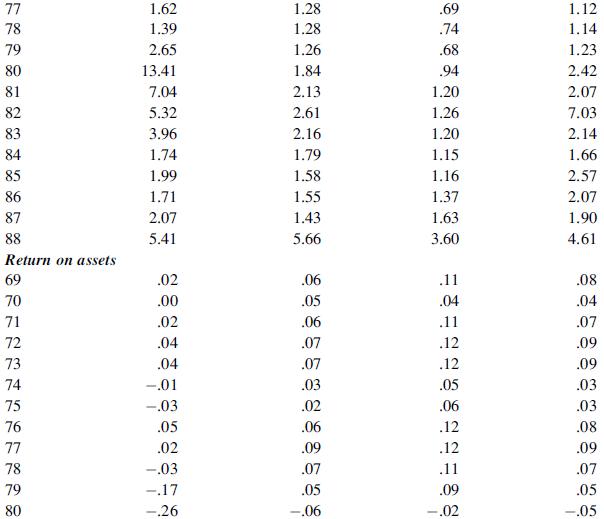

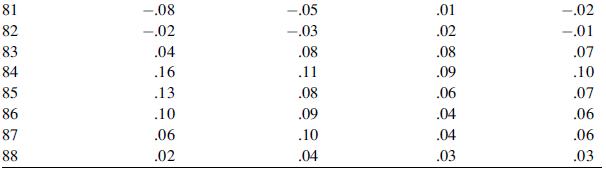

Use MINITAB and the following information to answer question. To find out whether there is a relationship between the amount of financial leverage a firm uses and the return on the firm’s assets, you collect information on the debt/equity ratio and return on assets for the “big three” automakers and the average for the auto industry.

Year Debt/equity ratio 69 70 71 72 73 74 75 76 Chrys. 1.23 1.23 1.20 1.21 1.24 1.53 1.60 1.51 Ford .76 .81 .89 .95 1.02 1.27 1.21 1.22 GM .45 .44 .69 .56 .62 .63 .66 .70 Indus. .74 .79 .91 .89 .92 1.09 1.10 1.08

Step by Step Solution

3.55 Rating (162 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts