Question: 7.1. Using risk-neutral valuation, derive a formula for a derivative that pays cash flows over the next two periods. Assume the risk-free rate is 4

7.1. Using risk-neutral valuation, derive a formula for a derivative that pays cash flows over the next two periods. Assume the risk-free rate is 4 percent per period.

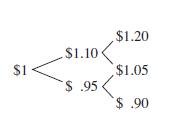

The underlying asset, which pays no cash flows unless it is sold, has a market value that is modeled in the adjacent tree diagram.

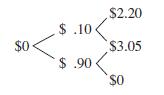

The cash flows of the derivative that correspond to the above tree diagram are

Find the present value of the derivative.

$1.10 $1.20 $1 $1.05 $.95 $ .90

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts