Sabel Co. purchased assembly equipment for $500,000 on January 1, Year 1. Sabels financial condition immediately prior

Question:

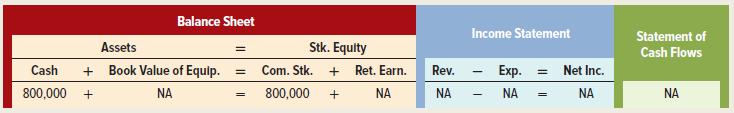

Sabel Co. purchased assembly equipment for $500,000 on January 1, Year 1. Sabel’s financial condition

immediately prior to the purchase is shown in the following horizontal statements model.

The equipment is expected to have a useful life of 200,000 miles and a salvage value of $20,000. Actual mileage was as follows:

Year 1 .................... 56,000

Year 2 .................... 61,000

Year 3 .................... 42,000

Year 4 .................... 36,000

Year 5 .................... 10,000

Required

a. Compute the depreciation for each of the five years, assuming the use of units-of-production depreciation.

b. Assume that Sabel earns $230,000 of cash revenue during Year 1. Record the purchase of the equipment and the recognition of the revenue and the depreciation expense for the first year in a financial statements model like the preceding one.

c. Assume that Sabel sold the equipment at the end of the fifth year for $20,600. Calculate the amount of gain or loss on the sale.

Step by Step Answer:

Survey Of Accounting

ISBN: 9781260575293

6th Edition

Authors: Thomas Edmonds, Christopher Edmonds, Philip Olds