Keller Consulting experienced the following transactions for 2006, its first year of operations, and 2007. Assume that

Question:

Keller Consulting experienced the following transactions for 2006, its first year of operations, and 2007. Assume that all transactions involve the receipt or payment ofcash.

Transactions for 2006

1. Acquired \($20,000\) by issuing common stock.

2. Received \($65,000\) cash for providing services to customers.

3. Borrowed \($25,000\) cash from creditors.

4. Paid expenses amounting to \($42,000\).

5. Purchased land for \($30,000\) cash.

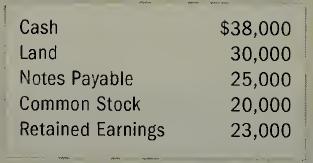

Transactions for 2007 Beginning account balances for 2007 are:

1. Acquired an additional \($24,000\) from the issue of common stock.

2. Received \($95,000\) for providing services.

3. Paid \($10,000\) to creditors to reduce loan.

4. Paid expenses amounting to \($71,500\).

5. Paid a \($6,000\) dividend to the stockholders.

6. Determined the market value of the land to be \($47,000\).

Required:

a. Write an accounting equation, and record the effects of each accounting event under the appropriate headings for each year. Record the amounts of revenue, expense, and dividends in the Retained Earnings column. Provide appropriate titles for these accounts in the last column of the table.

b. Prepare an income statement, statement of changes in stockholders’ equity, year-end balance sheet, and statement of cash flows for each year.

c. Determine the amount of cash that is in the retained earnings account at the end of 2006 and 2007.

d. Compare the information provided by the income statement with the information provided by? the statement of cash flows. Point out similarities and differences.

Step by Step Answer:

Survey Of Accounting

ISBN: 9780077503956

1st Edition

Authors: Thomas Edmonds, Philip Olds, Frances McNair, Bor-Yi Tsay