Quality Sports Equipment uses a line of credit to help finance its inventory purchases. Quality sells ski

Question:

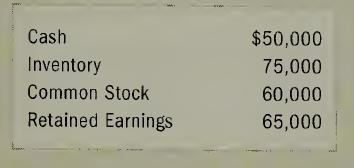

Quality Sports Equipment uses a line of credit to help finance its inventory purchases. Quality sells ski equipment and uses the line of credit to build inventory for its peak sales months, which tend to be clustered in the winter months. Account balances at the beginning of 2009 were as follows:

Quality experienced the following transactions for January, February, and March, 2009.

1. January 1, 2009, obtained approval for a line of credit of up to \($200,000\) . Funds are to be obtained or repaid on the first day of each month. The interest rate is the bank prime rate plus 1 percent.

2. January 1, 2009, borrowed \($30,000\) on the line of credit. The bank’s prime interest rate is 5 percent for January.

3. January 15, purchased inventory on account, \($68,000\) .

4. January 31, paid other operating expenses of \($8,000\) .

5. In January, sold inventory for \($65,000\) on account. The inventory had cost \($42,000\) .

6. January 31, paid the interest due on the line of credit.

7. February 1, borrowed \($60,000\) on the line of credit. The bank’s prime rate is 6 percent for February.

8. February 1, paid the accounts payable from transaction 3.

9. February 10, collected \($62,000\) of the sales on account.

10. February 20, purchased inventory on account, \($72,000\) .

11. February sales on account were \($110,000\). The inventory had cost \($75,000\) .

12. February 28, paid the interest due on the line of credit.

13. March 1, repaid \($20,000\) on the line of credit. The bank’s prime rate is 5 percent for March.

14. March 5, paid \($50,000\) of the accounts payable.

15. March 10, collected \($105,000\) from accounts receivable.

16. March 20, purchased inventory on account, \($72,000\) .

17. March sales on account were \($135,000\) . The inventory had cost \($87,000\) .

18. March 31, paid the interest due on the line of credit.

Required:

a. What is the amount of interest expense for January? February? March?

b. What amount of cash was paid for interest in January? February? March?

Step by Step Answer:

Survey Of Accounting

ISBN: 9780073526775

1st Edition

Authors: Thomas Edmonds, Philip Olds, Frances McNair, Bor-Yi Tsay