Question: Derive cash flow statement from the given balance sheet (Table 8. 25) and income statement of a firm (Table 8. 26). Then, complete the balance

Derive cash flow statement from the given balance sheet (Table 8. 25) and income statement of a firm (Table 8. 26). Then, complete the balance sheet and check it. Analyze the financial position of the firm. Write your assumptions if there are any. Present the details of your computations. (Hint: Amortization expenses equals $5m. Assume all dividends were cash dividends.)

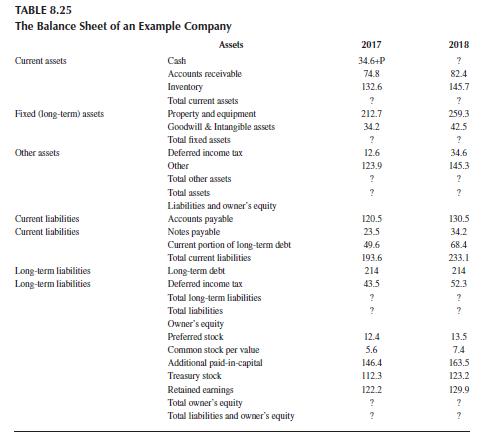

TABLE 8.25 The Balance Sheet of an Example Company Assets 2017 2018 Current assets Cash 34.6+P ? Accounts receivable 74.8 82.4 Inventory 132.6 145.7 Total current assets ? ? Fixed (long-term) assets Property and equipment 212.7 259.3 Goodwill & Intangible assets 34.2 42.5 Total fixed assets ? ? Other assets Deferred income tax 12.6 34.6 Other 123.9 145.3 Total other assets ? ? Total assets ? 2 Liabilities and owner's equity Current liabilities Current liabilities Accounts payable 120.5 130.5 Notes payable 23.5 34.2 Current portion of long-term debt 49.6 68.4 Total current liabilities 193.6 233.1 Long-term liabilities Long-term liabilities Total long-term liabilities Total liabilities Long-term debt 214 214 Deferred income tax 43.5 52.3 ? ? ? ? Owner's equity Preferred stock 12.4 13.5 Common stock per value 5.6 7.4 Additional paid-in-capital 146.4 163.5 Treasury stock 112.3 123.2 Retained earnings 122.2 129.9 Total owner's equity ? ? Total liabilities and owner's equity ? ?

Step by Step Solution

3.31 Rating (142 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts