In 2022, Deon and NeNe are married filing jointly. Deon and NeNes taxable income is $1,090,000, and

Question:

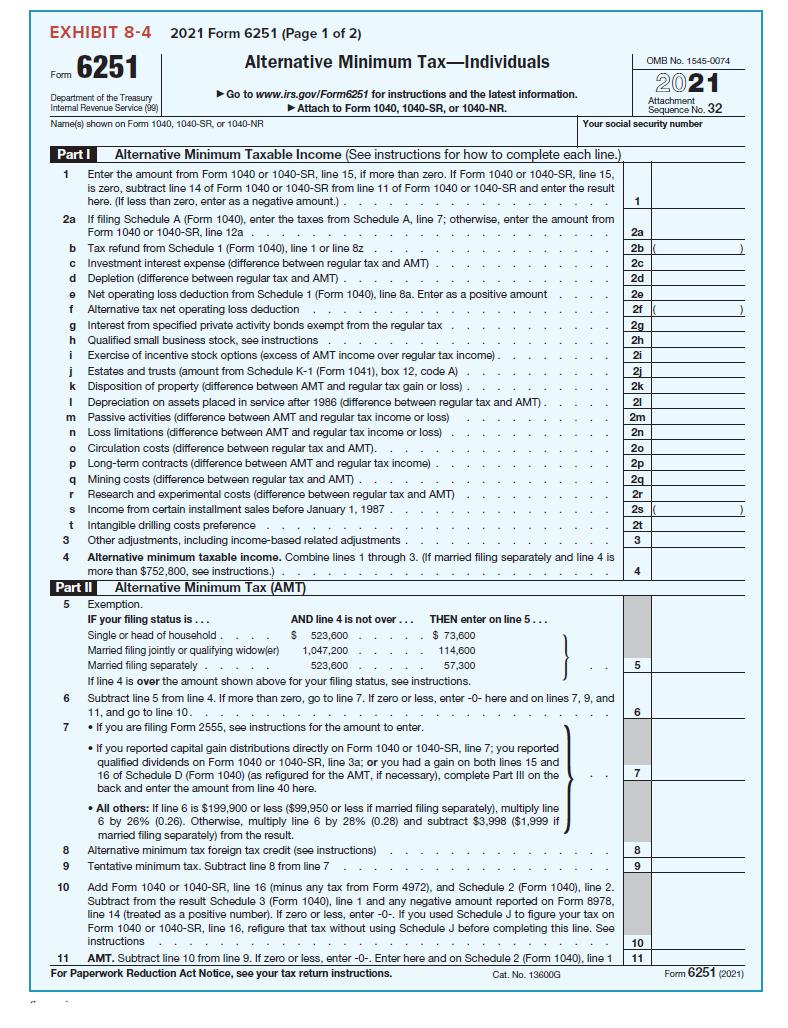

In 2022, Deon and NeNe are married filing jointly. Deon and NeNe’s taxable income is $1,090,000, and they itemize their deductions as follows: real property taxes of $10,000, charitable contributions of $30,000, and mortgage interest expense of $40,000 ($700,000 acquisition debt for home). What is Deon and NeNe’s AMT? Complete Form 6251 for Deon and NeNe.

From 6251

Transcribed Image Text:

EXHIBIT 8-4 2021 Form 6251 (Page 1 of 2) Form 6251 Department of the Treasury Internal Revenue Service (99) Name(s) shown on Form 1040, 1040-SR, or 1040-NR b c d Part I Alternative Minimum Taxable Income (See instructions for how to complete each line.) Enter the amount from Form 1040 or 1040-SR, line 15, if more than zero. If Form 1040 or 1040-SR, line 15, is zero, subtract line 14 of Form 1040 or 1040-SR from line 11 of Form 1040 or 1040-SR and enter the result here. (If less than zero, enter as a negative amount.). ... 1 2a If filing Schedule A (Form 1040), enter the taxes from Schedule A, line 7; otherwise, enter the amount from Form 1040 or 1040-SR, line 12a. j k Alternative Minimum Tax-Individuals 1 I ►Go to www.irs.gov/Form6251 for instructions and the latest information. ► Attach to Form 1040, 1040-SR, or 1040-NR. e Net t operating loss deduction from Schedule 1 (Form 1040), line 8a. Enter as a positive amount Alternative tax net operating loss deduction f duction g Interest from specified private activity bonds exempt from the regular tax h Qualified small business stock, see instructions i Exercise of incentive stock options (excess of AMT income over regular tax income) Fa Estates and trusts (amount from Schedule K-1 (Form 1041), box 12, code A) Disposition of property (difference between AMT and regular tax gain or loss) Depreciation on assets placed in service after 1986 (difference between regular tax and AMT). m Passive activities (difference between AMT and regular tax income or loss) n Loss limitations (difference between AMT and regular tax income or loss) o Circulation costs (difference between regular tax and AMT). p Long-term contracts (difference between AMT and regular tax income) q Mining costs (difference between regular tax and AMT) r Research and experimental costs (difference between regular tax and AMT) s Income from certain installment sales before January 1, 1987. t Intangible drilling costs preference..... 3 Other adjustments, including income-based related adjustments Tax refund from Schedule 1 (Form 1040), line 1 or line 8z Investment interest expense (difference between regular tax and AMT) Depletion (difference between regular tax and AMT) 8 9 10 - ... 4 Alternative minimum taxable income. Combine lines 1 through 3. (If married filing separately and line 4 is more than $752,800, see instructions.) Part II Alternative Minimum Tax (AMT) 5 Exemption. IF your filing status is ... Single or head of household. ... Married filing jointly or qualifying widow(er) Married filing separately..... If line 4 is over the amount shown above for your filing status, see instructions. AND line 4 is not over... $ 523,600 1,047,200 523,600 THEN enter on line 5... $ 73,600 114,600 57,300 6 Subtract line 5 from line 4. If more than zero, go to line 7. If zero or less, enter -0- here and on lines 7, 9, and 11, and go to line 10... 7. If you are filing Form 2555, see instructions for the amount to enter. sen Your social security number • If you reported capital gain distributions directly on Form 1040 or 1040-SR, line 7; you reported qualified dividends on Form 1040 or 1040-SR, line 3a; or you had a gain on both lines 15 and 16 of Schedule D (Form 1040) (as refigured for the AMT, if necessary), complete Part III on the back and enter the amount from line 40 here. • All others: If line 6 is $199,900 or less ($99,950 or less if married filing separately), multiply line 6 by 26% (0.26). Otherwise, multiply line 6 by 28% (0.28) and subtract $3,998 ($1,999 if married filing separately) from the result. Alternative minimum tax foreign tax credit (see instructions) Tentative minimum tax. Subtract line 8 from line 7 Add Form 1040 or 1040-SR, line 16 (minus any tax from Form 4972), and Schedule 2 (Form 1040), line 2. Subtract from the result Schedule 3 (Form 1040), line 1 and any negative amount reported on Form 8978, line 14 (treated as a positive number). If zero or less, enter -0-. If you used Schedule J to figure your tax on Form 1040 or 1040-SR, line 16, refigure that tax without using Schedule J before completing this line. See instructions..... ...... ... 11 AMT. Subtract line 10 from line 9. If zero or less, enter -0-. Enter here and on Schedule 2 (Form 1040), line 1 For Paperwork Reduction Act Notice, see your tax return instructions. Cat. No. 13600G 1 2a 2b 2c 2d 2e 2f 2g 2h 21 2j 2k 21 2m 2n 20 2p 2q 2r 2s 2t 3 4 5 6 7 OMB No. 1545-0074 2021 Attachment Sequence No. 32 8 9 10 11 Form 6251 (2021)

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 73% (15 reviews)

Deon and NeNe will not owe AMT AMT Description Amount Reference 1 Regular taxable income 1090000 2 Real property taxes 10000 3 AMTI 1100000 1 2 4 Full ...View the full answer

Answered By

Utsab mitra

I have the expertise to deliver these subjects to college and higher-level students. The services would involve only solving assignments, homework help, and others.

I have experience in delivering these subjects for the last 6 years on a freelancing basis in different companies around the globe. I am CMA certified and CGMA UK. I have professional experience of 18 years in the industry involved in the manufacturing company and IT implementation experience of over 12 years.

I have delivered this help to students effortlessly, which is essential to give the students a good grade in their studies.

3.50+

2+ Reviews

10+ Question Solved

Related Book For

Taxation Of Individuals And Business Entities 2023 Edition

ISBN: 9781265790295

14th Edition

Authors: Brian Spilker, Benjamin Ayers, John Barrick, Troy Lewis, John Robinson, Connie Weaver, Ronald Worsham

Question Posted:

Students also viewed these Business questions

-

In 2017, Deon and NeNe are married filing jointly. They have three dependent children under 18 years of age. Deon and NeNe's AGI is $813,800, their taxable income is $722,750, and they itemize their...

-

In 2014, Deon and NeNe are married filing jointly. They have three dependent children under 18 years of age. Deon and NeNe's AGI is $805,050, their taxable income is $714,000, and they itemize their...

-

In 2015, Deon and NeNe are married filing jointly. They have three dependent children under 18 years of age. Deon and NeNe's AGI is $809,900, their taxable income is $718,850, and they itemize their...

-

Prepare the journal entries for 2, 4, 6, 8, 12 and 14 using the following information 6% bonds $1200000 par value payable in 5 years were issued for cash at 108, any premium is to be transferred to...

-

Top management has called in a consultant for the area you work in. What action should you take to protect yourself and your interests?

-

Squamata includes _____. a. Crocodiles and alligators b. Turtles c. Tuataras d. Lizards and snakes

-

Assume the same data as given in problem 9, except the company expects the following production: Case A: 300 bbl per month Case B: 500 bbl per month REQUIRED: a. Determine the number of months needed...

-

The following information is available for Wenger Corporation for 2008. 1. Excess of tax depreciation over book depreciation, $40,000. This $40,000 difference will reverse equally over the years...

-

Compare and contrast benefits and challenges that exist between centralized database management systems and distributed database management systems. Identify potential business environments where...

-

While crossing an intersection, the client was struck by a vehicle driven by a minor. The minor's parents owned the vehicle, and the minor was driving with their knowledge and consent. The minor has...

-

Brooklyn files as a head of household for 2022. They claimed the standard deduction of $19,400 for regular tax purposes. Their regular taxable income was $80,000. What is Brooklyns AMTI?

-

In 2022, Carson is claimed as a dependent on his parents tax return. His parents report taxable income of $200,000 (married filing jointly). Carsons parents provided most of his support. What is...

-

On January 1, 2020, Geffrey Corporation had the following stockholders equity accounts. Common Stock ($20 par value, 60,000 shares issued and outstanding) ............................ $1,200,000...

-

At a used car lot, a nearly new car with only 2,000 miles on the odometer is selling for half the cars original price. The salesperson tells you that the car was driven by a little old lady from...

-

An article in the Wall Street Journal in 2012 described investors behavior since 2000 as a flight to safety that has led to a high equity risk premium. a. What does flight to safety mean? In this...

-

A column in the Wall Street Journal observes that while many people buy stocks in the hope of scoring profits down the road, dividends deliver cash right now. If stockholders desire dividends, why do...

-

An article in the Wall Street Journal made the following comment on the surge in corporations selling long-term bonds in 2012: For investors, the longer maturities provide better returns than...

-

Briefly explain in which of the following situations moral hazard is likely to be less of a problem. a. A manager is paid a flat salary of $150,000. b. A manager is paid a salary of $75,000 plus 10%...

-

a. Suppose that 0 < q < p and that n = + O(np). Show that n = + O(nq). b. Make a table listing 1/n, 1/n2, 1/n3, and 1/n4 for n = 5, 10, 100, and 1000, and discuss the varying rates of convergence...

-

On January 1, 2017, McIlroy, Inc., acquired a 60 percent interest in the common stock of Stinson, Inc., for $340,200. Stinson's book value on that date consisted of common stock of $100,000 and...

-

In 2020, Rashaun (62 years old) retired and planned on immediately receiving distributions (making withdrawals) from his traditional IRA account. The balance of his IRA account is $160,000 (before...

-

In 2020, Susan (44 years old) is a highly successful architect and is covered by an employee-sponsored plan. Her husband, Dan (47 years old), however, is a Ph.D. student and is unemployed. Compute...

-

William is a single writer (age 35) who recently decided that he needs to save more for retirement. His 2020 AGI before the IRA contribution deduction is $66,000 (all earned income). a. If he does...

-

Foxx Corporation acquired all of Greenburg Companys outstanding stock on January 1, 2016, for $646,000 cash. Greenburgs accounting records showed net assets on that date of $497,000, although...

-

On January 1, 2019, Biscayne Corporation purchased 80% of Arches corporation for $1,000,000. On December 31, 2019, Biscayne reports revenues of $800,000 and expenses of $450,000, and Arches reports...

-

In its first month's operations (January 2016,, Allred Company's Department 1 incurred charges of $360,000 for direct materials (15,000 units), $99,000 for direct labor, and $174,000 for...

Study smarter with the SolutionInn App