Karane Enterprises, a calendar-year manufacturer based in College Station, Texas began business in 2019. In the process

Question:

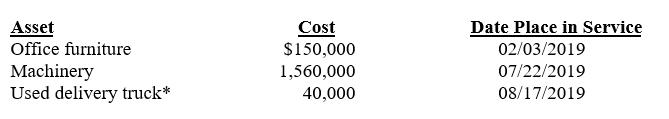

Karane Enterprises, a calendar-year manufacturer based in College Station, Texas began business in 2019. In the process of setting up the business, Karane has acquired various types of assets. Below is a list of assets acquired during 2019:

*Not considered a luxury automobile.

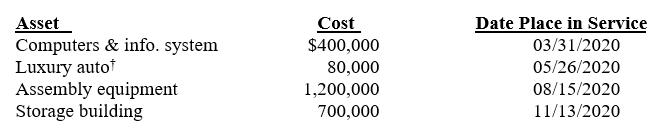

During 2019, Karane was very successful (and had no §179 limitations) and decided to acquire more assets in 2020 to increase its production capacity. These are the assets acquired during 2020:

†Used 100% for business purposes.

Karane generated taxable income in 2020 of $1,732,500 for purposes of computing the §179 expense limitation.

Required

a. Compute the maximum 2019 depreciation deductions, including §179 expense (ignoring bonus depreciation).

b. Compute the maximum 2020 depreciation deductions, including §179 expense (ignoring bonus depreciation).

c. Compute the maximum 2020 depreciation deductions, including §179 expense, but now assume that Karane would like to take bonus depreciation.

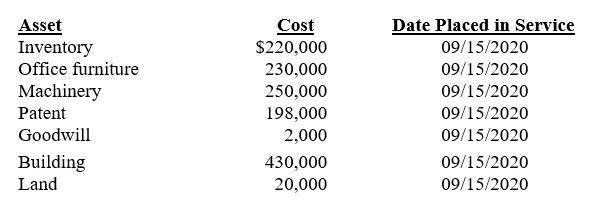

d. Now assume that during 2020, Karane decides to buy a competitor’s assets for a purchase price of $1,350,000. Compute the maximum 2020 cost recovery, including §179 expense and bonus depreciation. Karane purchased the following assets for the lump-sum purchase price.

e. Complete Part I of Form 4562 for part (b) (use the most current form available).

Step by Step Answer:

Taxation Of Individuals And Business Entities 2021

ISBN: 9781260247138

12th Edition

Authors: Brian Spilker, Benjamin Ayers, John Barrick, Troy Lewis, John Robinson, Connie Weaver, Ronald Worsham