Question: A company has the following results for its three most recent accounting periods: Trading profits/(losses) Chargeable gains Gift Aid donations y/e 31/5/16 59,700 8,400 1,000

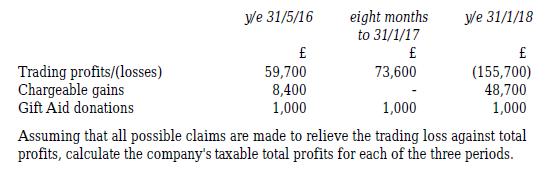

A company has the following results for its three most recent accounting periods:

Trading profits/(losses) Chargeable gains Gift Aid donations y/e 31/5/16 59,700 8,400 1,000 eight months to 31/1/17 73,600 We 31/1/18 (155,700) 48,700 1,000 1,000 Assuming that all possible claims are made to relieve the trading loss against total profits, calculate the company's taxable total profits for each of the three periods.

Step by Step Solution

3.35 Rating (155 Votes )

There are 3 Steps involved in it

Based on the image presented we can calculate the companys taxable total profits for each of the three accounting periods by taking into account tradi... View full answer

Get step-by-step solutions from verified subject matter experts