Diane (who is not a Scottish taxpayer) is self-employed and a member of three registered pension schemes.

Question:

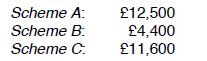

Diane (who is not a Scottish taxpayer) is self-employed and a member of three registered pension schemes. Her pension input amounts for 2020-21 are as follows:

Diane's "adjusted income" for 2020-21 is £296,000 and her marginal rate of income tax for the year is 45%. Her "threshold income" for 2020-21 exceeds £200,000. Compute the annual allowance charge for the year, assuming that there is no unused annual allowance to bring forward from the previous three years.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: