Ian owns a large manufacturing business and prepares accounts to 31 March each year. The written down

Question:

Ian owns a large manufacturing business and prepares accounts to 31 March each year.

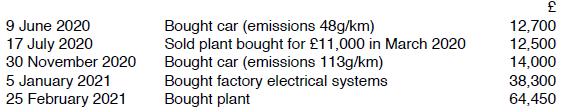

The written down value of his main pool of plant and machinery after deducting capital allowances for the year to 31 March 2020 was £116,250. There was no special rate pool on that date. Ian's purchases and sales of plant and machinery for the year to 31 March 2021 were as follows:

The electrical systems bought in January 2021 qualify as "integral features" of a building for capital allowances purposes. Prepare a capital allowances computation for the year to 31 March 2021, assuming that maximum allowances are claimed.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: