Question: The ordinary share capital of PP Ltd (a trading company) is owned 32% by QQ Ltd, 35% by RR Ltd, 23% by SS Ltd. The

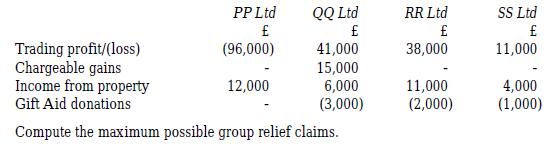

The ordinary share capital of PP Ltd (a trading company) is owned 32% by QQ Ltd, 35% by RR Ltd, 23% by SS Ltd. The remaining 10% is owned by various individuals, none of whom own more than 1%. All companies are UK resident and prepare accounts to 31 July. Results for the year to 31 July 2017 are as follows:

PP Ltd (96,000) 12,000 QQ Ltd Trading profit/(loss) Chargeable gains Income from property Gift Aid donations Compute the maximum possible group relief claims. 41,000 15,000 6,000 (3,000) RR Ltd 38,000 11,000 (2,000) SS Ltd 11,000 4,000 (1,000)

Step by Step Solution

3.51 Rating (154 Votes )

There are 3 Steps involved in it

I see here that you have provided a financial summary of several companies along with their ownership structure and you have asked to compute the maxi... View full answer

Get step-by-step solutions from verified subject matter experts