Timberlake Ltd prepares accounts to 31 March each year. The company made the following disposals of chargeable

Question:

Timberlake Ltd prepares accounts to 31 March each year. The company made the following disposals of chargeable assets in the year to 31 March 2021:

(i) In February 2021, a rare Bentley motor car used by the company's Managing Director was sold for £750,000. This car had cost £300,000 in November 2004.

(ii) In October 2020, an office building was sold for £680,000. The building had been acquired in January 1979 for £100,000 and was extended in July 1981 at a cost of

£10,000 and again in September 1988 at a cost of £40,000. The market value of the building on 31 March 1982 was £135,000.

(iii) In June 2020, a plot of land was sold for £120,000. This land had cost £42,000 in November 2004 and had been used for trade purposes.

In June 2005, the company had sold land for £50,000 and had made a claim for rollover relief in relation to this disposal. This land had cost £10,000 in October 1999 and had been used for trade purposes.

(iv) In August 2020, gilt-edged stocks bought for £100,000 in January 2008 were sold for £110,500.

(v) In June 2020, plant and machinery which was bought for £19,500 in August 2019 was sold for £22,500. In March 2021, plant and machinery bought for £16,000 in March 2017 was sold for £9,000. Capital allowances had been claimed in relation to both of these items.

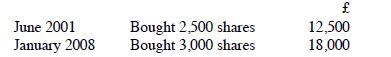

(vi) In February 2021, the company sold 500 ordinary shares in Theta plc for £10 per share. Timberlake Ltd had bought ordinary shares in Theta plc as follows:

Timberlake Ltd has elected that assets acquired before 31 March 1982 should be treated as if acquired on 31 March 1982 at a cost equal to their market value on that date. The company had capital losses brought forward of £156,200 on 1 April 2020.

Required:

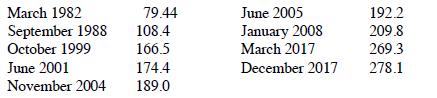

(a) Compute the chargeable gain or allowable loss arising on each of the disposals made during the year to 31 March 2021. Assume Retail Price Indices as follows:

(b) Compute the chargeable gains figure which should be included in the company's taxable total profits for the year to 31 March 2021.

Step by Step Answer: