Zunilda is a 77-year-old individual with an AGI of $25,000 in 2014. She began living in a

Question:

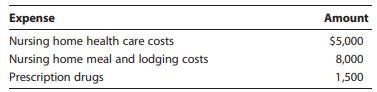

Zunilda is a 77-year-old individual with an AGI of $25,000 in 2014. She began living in a nursing home in 2014 upon the recommendation of her primary care physician in order to receive medical care for a specific condition. She had the following unreimbursed expenses in 2014:

As a result of these unreimbursed expenses, how much may Zunilda deduct from AGI on her 2014 tax return? Assume Zunilda elects to itemize deductions.

a. $12,000

b. $4,000

c. $12,625

d. $4,625

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Essentials Of Taxation 2016 Individuals And Business Entities

ISBN: 9781305395305

39th Edition

Authors: William A. Raabe, David M. Maloney, James C. Young, William H. Jr. Hoffman

Question Posted: