Maria Sanchez, the sole proprietor of a consulting business, has gross receipts of $720,000. Expenses paid by

Question:

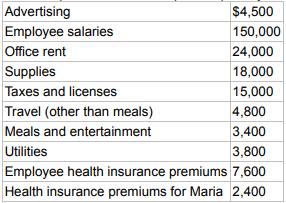

Maria Sanchez, the sole proprietor of a consulting business, has gross receipts of $720,000. Expenses paid by her business are:

Maria purchased a new car for her business on June 18 for $39,000. She also purchased $90,000 of new computer equipment and $128,000 of used 7-year fixtures on August 1, and $200,000 of new 7-year equipment on September 15. Maria drove the car 20,000 miles (16,000 for business and 4,000 personal miles). She paid $250 for business-related parking and tolls. She also paid $1,200 for insurance and $1,400 for gasoline and oil for the new car. She would like to maximize her deductions.

She operates her consulting business at 111 Sand Lake Road, Orlando, Florida as Maria Sanchez Consulting. Her SSN is 155-46-6789 and her home address is 1234 Universal Avenue, Orlando, Florida 32819. She is a single individual with no dependents, claims the standard deduction, and has no other income. She paid $16,000 in estimated federal income taxes.

a. Go to the IRS Web site at www.irs.gov and print Form 4562. Complete this form using the information above.

b. Print Form 1040, Schedule C, and Schedule SE. Complete these forms to the extent possible.

Step by Step Answer:

Taxation For Decision Makers 2018

ISBN: 9781119373735

8th Edition

Authors: Shirley Dennis Escoffier, Karen Fortin