On March 15, 2015, James Smith formed a business to rent and service vending machines providing healthy

Question:

On March 15, 2015, James Smith formed a business to rent and service vending machines providing healthy snack alternatives and juices to the local middle and high schools. He operates the business as a sole proprietorship from his home, turning the den into an office from which he manages the business. The den contains 400 of the home’s total 1,800 square feet. In addition, he rents additional space in a warehouse complex where he stores his inventory.

When he formed the business, he converted his Ford pick-up truck solely to business use to deliver machines and products to the schools. When converted, the truck had a basis of $18,250 and a fair market value of $12,500. He purchased a small car for his personal use.

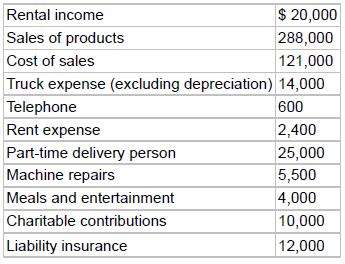

During 2017, the business reported the following:

In April of 2015, James bought 20 vending machines for $60,000; in April of 2016, he bought 20 more machines for $65,000; in June of the current year, he purchased 10 more vending machines for $35,000. All vending machines have a seven-year life and are depreciated under MACRS.

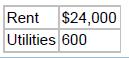

James did not elect Section 179 expensing or bonus depreciation in any year. James’s expenses related to his home are

In December, James sold the original truck for $5,000 and purchased a new truck for $24,000.

Determine James’s income or loss from the business. Do not include in this figure items that would not be included on his Schedule C but detail those items separately. Calculate James’s self-employment taxes assuming he has no other income subject to FICA taxes.

Step by Step Answer:

Taxation For Decision Makers 2018

ISBN: 9781119373735

8th Edition

Authors: Shirley Dennis Escoffier, Karen Fortin