Colorado legalized the recreational use of marijuana in 2014 to raise revenues through sales and excise taxes.

Question:

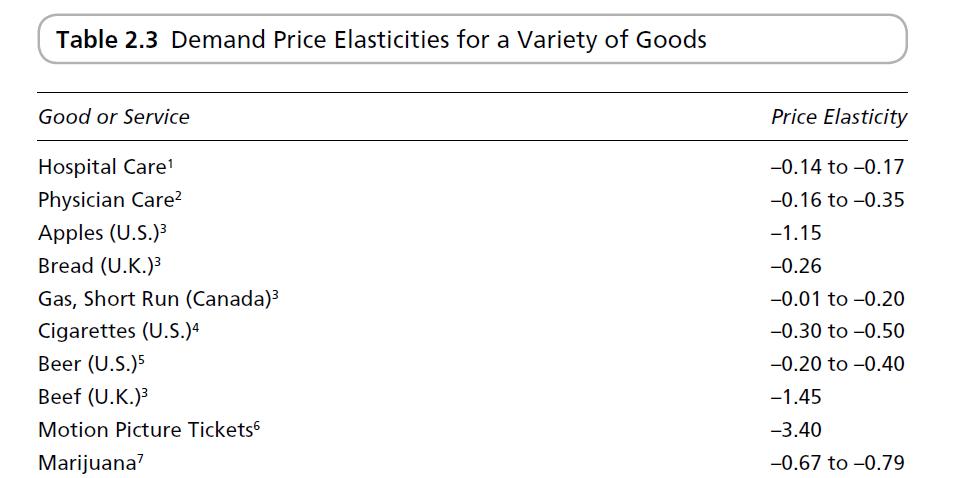

Colorado legalized the recreational use of marijuana in 2014 to raise revenues through sales and excise taxes. In Denver, 1/8 ounce of marijuana costing $30 had about $8 in various taxes added on. Assuming a price elasticity of demand for marijuana of –0.7 (see Table 2.3), determine the percentage change in quantity that would result from a price increase of $8. Under what circumstances would prices rise by less than the full amount of a tax? How does the price elasticity of demand affect tax revenues?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

The Economics Of Health And Health Care

ISBN: 9781138208049

8th Edition

Authors: Sherman Folland, Allen C. Goodman, Miron Stano

Question Posted: