The Monteiro Manufacturing Corporation manufactures and sells folding umbrellas. The corporations condensed income statement for the year

Question:

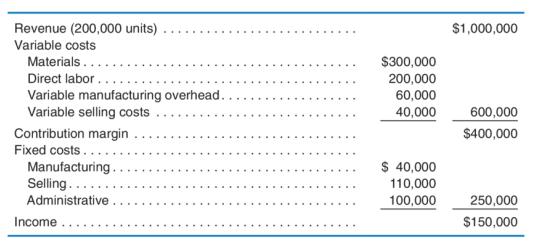

The Monteiro Manufacturing Corporation manufactures and sells folding umbrellas. The corporation’s condensed income statement for the year ended December 31, 2019, follows:

Monteiro’s budget committee has estimated the following changes for 2020:

- 30% increase in number of units sold

- 20% increase in material cost per unit

- 15% increase in direct labor cost per unit

- 10% increase in variable manufacturing cost per unit

- 5% increase in fixed manufacturing costs

- 6% increase in administrative expenses

Required

(a) Compute the unit sales price at which the Monteiro Manufacturing Corporation must sell its umbrellas in 2020 in order to earn a budgeted profit of $200,000.

(b) Unhappy about the prospect of an increase in selling price, Monteiro’s sales manager wants to know how many units must be sold at the old price to earn the $200,000 budgeted profit. Compute the number of units that must be sold at the old price to earn $200,000.

(c) Believing that the estimated increase in sales is overly optimistic, one of the company’s directors wants to know what annual profit is likely if the selling price determined in part a is adopted but the increase in sales volume is only 10%. Compute the budgeted profit in this case.

Step by Step Answer:

Management Accounting Information For Decision Making

ISBN: 9781618533517

7th Edition

Authors: Anthony A. Atkinson