According to its 2020 annual financial statements, BRP Inc. designs, develops, manufacturers, and sells powersport vehicles and

Question:

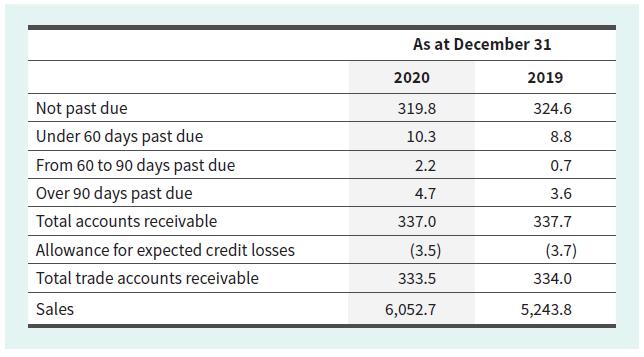

According to its 2020 annual financial statements, BRP Inc. designs, develops, manufacturers, and sells powersport vehicles and marine products worldwide. BRP’s 2020 financial statements contained the following information, in millions of Canadian dollars:

Required

a. How has the age mix of BRP’s receivables changed from 2019 to 2020?

b. What percentages of BRP’s accounts receivable were considered uncollectible in each of 2020 and 2019? Is the trend favourable or unfavourable?

c. Calculate BRP’s accounts receivable turnover rates for 2020 and 2019 using the ending balances of the receivables for each year rather than the average receivables. Is the trend favourable or unfavourable?

d. What was the average number of days taken by BRP to collect its accounts receivable in 2020? In 2019? If the company’s receivables are generally due on 30-day terms, how is the company doing in terms of collecting its receivables on a timely basis?

Step by Step Answer:

Understanding Financial Accounting

ISBN: 9781119715474

3rd Canadian Edition

Authors: Christopher D. Burnley