Alimentation Couche-Tard Inc. operates over 8,000 convenience stores in North America, Scandinavia, Poland, the Baltics, and Russia.

Question:

Alimentation Couche-Tard Inc. operates over 8,000 convenience stores in North America, Scandinavia, Poland, the Baltics, and Russia. The Laval, Quebec–based company generates income primarily from the sale of tobacco products, grocery items, beverages, fresh food (including quick service restaurants), and fuels. It operates in Canada mainly under the Mac’s and Couche-Tard brands. Note 20(a) from the company’s 2016 annual report in Exhibit 10.12 details Couche-Tard’s senior unsecured notes (in millions).

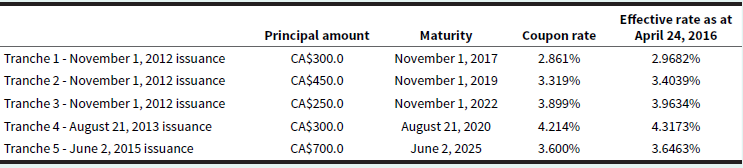

EXHIBIT 10.12 Excerpt from Alimentation Couche-Tard Inc.’s 2016 Annual Report

(a) Canadian dollar denominated senior unsecured notes On June 2, 2015, the Corporation issued Canadian dollar denominated senior unsecured notes totaling CA$ 700.0 ($564.2) (tranche 5). Interest is payable semi-annually on June 2 and December 2 of each year. The Corporation used the net proceeds from the issuance to repay a portion of its term revolving unsecured operating credit D.

Notes to the Consolidated Financial Statements

For the fiscal years ended April 24, 2016 and April 26, 2015

(in millions of US dollars (Note 2), except share and stock option data)

As at April 24, 2016, the Corporation had Canadian dollar denominated senior unsecured notes totalling CA$2.0 billion, divided as follows:

Notes issued on November 1, 2012 and June 2, 2015 are subject to cross-currency interest rate swaps (Note 21).

Required

a. Look at Couche-Tard’s three tranches (which are portions of a bond issue that have different maturity dates, interest rates, and so on) of senior unsecured notes issued in 2012. Comment on the relationship between the interest rates and the length of time to maturity of the notes. As an investor, explain why this relationship is important to you.

b. Explain why Couche-Tard may have wanted to spread the 2012 borrowings across three tranches with different maturities.

c. What do we know about these notes given that the eff ective rates of interest are higher than the coupon rates for all five tranches?

CorporationA Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer:

Understanding Financial Accounting

ISBN: 9781119406921

2nd Canadian Edition

Authors: Christopher D. Burnley