Question: Comparative financial statement data for Cool Brewery Ltd. and Northern Beer Ltd., two competitors, follow (amounts in thousands): Required a. Prepare a common-size analysis for

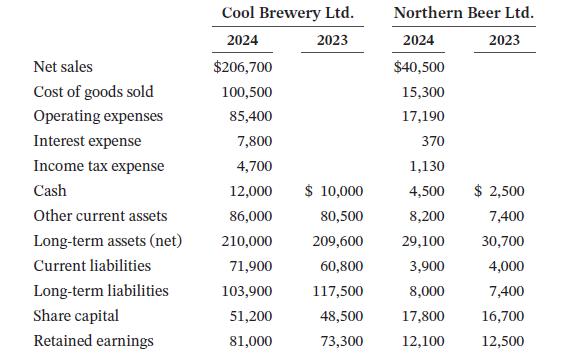

Comparative financial statement data for Cool Brewery Ltd. and Northern Beer Ltd., two competitors, follow (amounts in thousands):

Required

a. Prepare a common-size analysis for 2024 for Cool Brewery Ltd. and Northern Beer Ltd.

b. Calculate the return on assets and the return on shareholders’ equity for both companies.

c. Comment on the relative profitability of these companies.

d. Based on your calculations above, identify two main reasons for the difference in their profitability.

e. Calculate the debt to equity ratio for both companies at the end of 2024.

f. Calculate the net debt as a percentage of total capitalization for both companies.

g. Compare the use of leverage by these companies based on the ratios calculated in parts (e) and (f).

Net sales Cost of goods sold Operating expenses Interest expense Income tax expense Cash Other current assets Long-term assets (net) Current liabilities Long-term liabilities Share capital Retained earnings Cool Brewery Ltd. 2024 2023 $206,700 100,500 85,400 7,800 4,700 12,000 86,000 210,000 71,900 103,900 51,200 81,000 $ 10,000 80,500 209,600 60,800 117,500 48,500 73,300 Northern Beer Ltd. 2024 2023 $40,500 15,300 17,190 370 1,130 4,500 8,200 29,100 3,900 8,000 17,800 12,100 $ 2,500 7,400 30,700 4,000 7,400 16,700 12,500

Step by Step Solution

3.48 Rating (164 Votes )

There are 3 Steps involved in it

a b c All performance measures indicate Northern Beer is more profitable than Cool Brewery Its profi... View full answer

Get step-by-step solutions from verified subject matter experts