Question: During fiscal 2008, Corus completed a stock split. Answer the following questions about the stock split. a. Describe the stock split. b. What effect did

During fiscal 2008, Corus completed a stock split. Answer the following questions about the stock split.

a. Describe the stock split.

b. What effect did the stock split have on the financial statements?

c. What journal entry would Corus have recorded as a result of the stock split?

d. If you looked at the August 31, 2007 annual report, how many shares of each class of Corus’s common stock would you expect to see outstanding on August 31, 2007.

Explain your answer.

e. What impact, if any, do you think the stock split would have on Corus’s earnings per share? Explain.

f. What impact, if any, do you think the stock split would have had on Corus’s stock price? Explain.

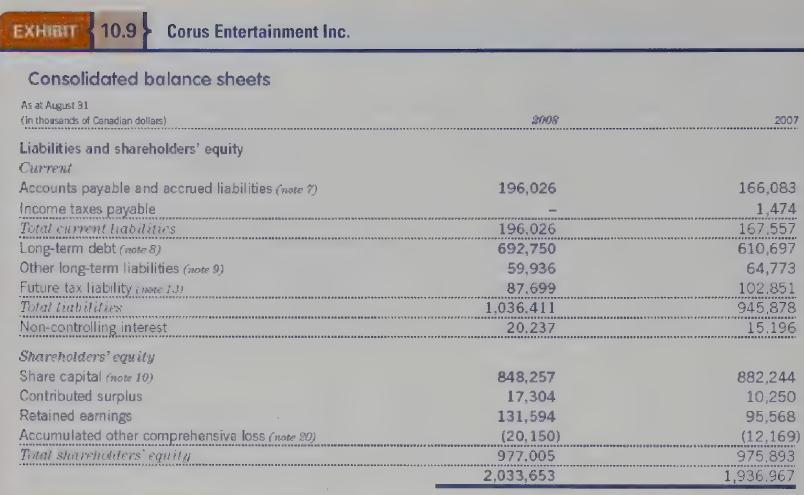

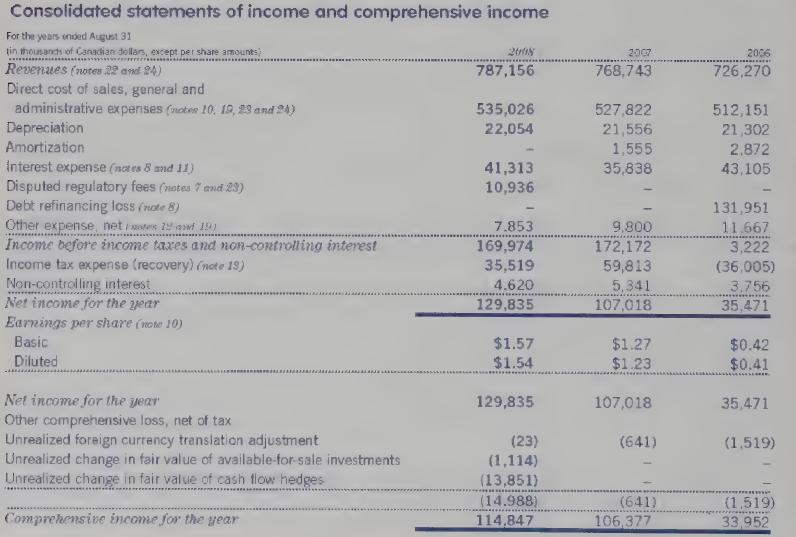

Corus Entertainment, Inc. (Corus), a media and entertainment company, engages in the radio and television broadcasting business in Canada. The company operates 53 radio stations, various specialty television networks focused on children and adult genres, and three broadcast television stations. It also produces and distributes children's programming and merchandise products, offers cable advertising and digital audio services, and publishes children's books in English. The company was founded in 1998 and is based in Toronto. Corus's Class B common shares trade on the TSX and the New York Stock Exchange.12 Corus's consolidated balance sheets, statements of income and comprehensive income and shareholders' equity, and extracts from the statements cash flows and the notes to the financial statements are provided in Exhibit 10.9.

EXHIBIT 10.9 Corus Entertainment Inc. Consolidated balance sheets As at August 31 (in thousands of Canadian dollars) 2008 2007 Liabilities and shareholders' equity Current Accounts payable and accrued liabilities (note?) 196,026 166,083 Income taxes payable 1,474 Total current liabdities 196.026 167.557 Long-term debt (note 8) 692,750 610,697 Other long-term liabilities (note 9) 59,936 64,773 Future tax liability note 131 87.699 102.851 Total liabilities Non-controlling interest 1,036.411 945,878 20.237 15.196 Shareholders' equity Share capital note 10) 848,257 882,244 Contributed surplus 17,304 10,250 Retained earnings 131,594 95,568 Accumulated other comprehensive loss (note 20) (20,150) (12,169) Total shareholders' equity 977.005 975,893 2,033,653 1,936.967

Step by Step Solution

3.42 Rating (158 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts