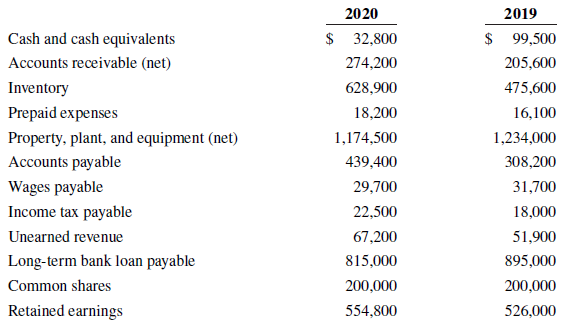

The following amounts were reported by Sindarius Ltd. in its most recent statement of financial position: The

Question:

The following amounts were reported by Sindarius Ltd. in its most recent statement of financial position:

The company had sales of $1,950,000 in 2020 and $1,990,000 in 2019. All sales were on account.

Required

a. Calculate the current ratio and quick ratio for Sindarius Ltd. for the current and preceding year. Comment on whether the ratios have improved or worsened.

b. If Sindarius’s bank loan includes covenants that the company must maintain a minimum current ratio of 1.5 and a minimum quick ratio of 0.7, what would you advise Sindarius’s management to do?

c. Calculate Sindarius’s accounts receivable turnover ratio and average collection period for the current and preceding years. For the accounts receivable turnover ratio, use the balance of accounts receivable at each year end for this calculation, rather than average balances. Comment on whether these ratios have improved or worsened.

d. If Sindarius’s normal credit terms are “n/45,” assess the company’s collection experience for the current and preceding years.

Step by Step Answer:

Understanding Financial Accounting

ISBN: 9781119406921

2nd Canadian Edition

Authors: Christopher D. Burnley