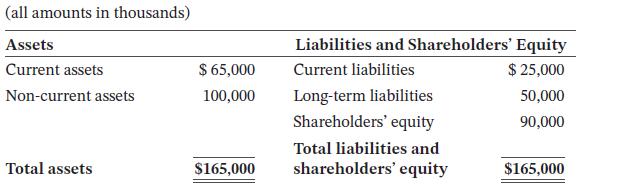

The statement of financial position as of December 31, 2024, for Taube Corporation follows: The companys management

Question:

The statement of financial position as of December 31, 2024, for Taube Corporation follows: The company’s management is evaluating a couple of options to finance the acquisition of new equipment with a cost of $35 million.

The company’s management is evaluating a couple of options to finance the acquisition of new equipment with a cost of $35 million.

Required

a. Taube has a cash balance of $20 million as of December 31, 2024. Determine the debt to equity ratio and net debt as a percentage of total capitalization ratio. Assume that only the company’s long-term liabilities are interest bearing.

b. Taube is considering borrowing $35 million by taking out a six-year bank loan that carries 10% interest payable semi-annually. Determine the company’s debt to equity and debt as a percentage of total capitalization ratios if it decides to borrow the money and purchase the equipment.

c. As an alternative to the bank loan, management is considering issuing $35 million in six-year bonds. The bonds pay 3% interest semi-annually and would be issued at 90.61 to yield 8%. Determine the company’s long-term debt to equity and debt as a percentage of total capitalization ratios if it decides to borrow money using bonds and purchase the equipment.

d. Which of options (b) or (c) is the better option for Taube and why?

Step by Step Answer:

Understanding Financial Accounting

ISBN: 9781119715474

3rd Canadian Edition

Authors: Christopher D. Burnley