Question: Using the following amounts (in thousands) reported in Tiger Tech Inc.s consolidated balance sheets and statements of income at December 31, 2024 and 2023, and

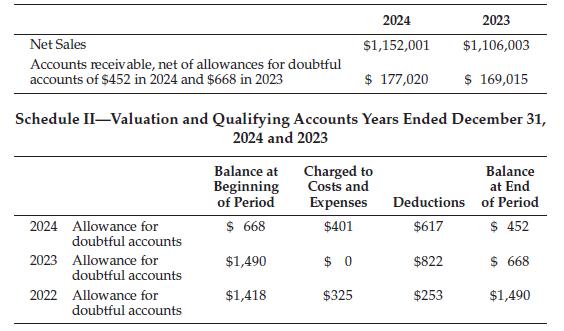

Using the following amounts (in thousands) reported in Tiger Tech Inc.’s consolidated balance sheets and statements of income at December 31, 2024 and 2023, and the valuation schedule, analyze the accounts receivable and allowance accounts for all years.

Net Sales Accounts receivable, net of allowances for doubtful accounts of $452 in 2024 and $668 in 2023 2024 $1,152,001 2023 $1,106,003 $ 177,020 $ 169,015 Schedule II-Valuation and Qualifying Accounts Years Ended December 31, 2024 and 2023 Balance at Charged to Balance Beginning Costs and at End of Period Expenses Deductions of Period 2024 Allowance for doubtful accounts $ 668 $401 $617 $ 452 2023 Allowance for doubtful accounts 2022 Allowance for doubtful accounts $1,490 $ 0 $822 $ 668 $1,418 $325 $253 $1,490

Step by Step Solution

3.45 Rating (158 Votes )

There are 3 Steps involved in it

Sales and accounts receivable have increased which is an expected pattern however it is unusual for ... View full answer

Get step-by-step solutions from verified subject matter experts