Value Seller Inc. (VSI) has a short-term working capital loan to help finance its working capital. The

Question:

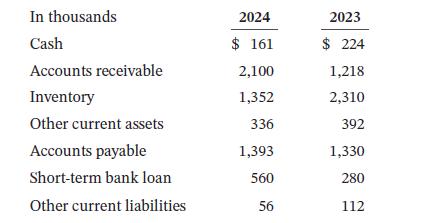

Value Seller Inc. (VSI) has a short-term working capital loan to help finance its working capital. The terms of the loan enable VSI to borrow an amount of up to 35% of its inventory balance and 55% of its accounts receivable. One of the loan covenants requires that VSI maintain a current ratio greater than 2.0. Information related to VSI’s current assets and current liabilities is shown in the following table:

Required

a. Does VSI satisfy the loan covenant in both years?

b. Based on the loan size requirement only of the loan covenant, how much more could VSI have borrowed in each year?

c. Based on a review of the accounts receivable balances, do you think sales have grown for VSI in 2024 over 2023?

d. How could the company improve its current position to ensure that VSI meets the loan covenant in 2024? What risks, if any, may be associated with the strategy you have suggested?

Step by Step Answer:

Understanding Financial Accounting

ISBN: 9781119715474

3rd Canadian Edition

Authors: Christopher D. Burnley