A supply and demand model can illustrate the difficulty of keeping a fixed exchange rate: Its much

Question:

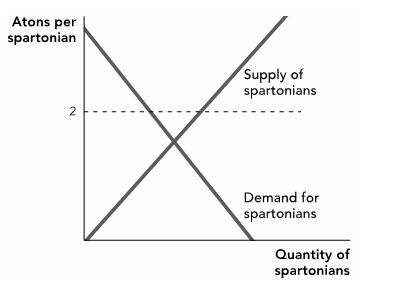

A supply and demand model can illustrate the difficulty of keeping a fixed exchange rate: It’s much the same as any other price floor. Consider the following fixed exchange rate. Sparta uses a currency called the spartonian, Athenians use the aton; the Spartans have chosen a fixed exchange rate of two atons per spartonian:

a. In a typical supply and demand model, what would you call the gap that exists between quantity supplied and quantity demanded at this fixed exchange rate: a surplus or a shortage? Of which currency?

b. If the Spartan government wants to keep this exchange rate fixed, what will tend to happen to its official reserve account supply of atons: Will it rise, or will it tend to fall?

c. If demand for spartonians fell because of a weak Spartan economy, would this make it harder or easier for this government to maintain the exchange rate?

d. If the Spartan government wanted to bring quantity supplied and quantity demanded closer together, would it want to slow money growth or raise money growth? When real-world countries have “overvalued” currencies, do you think they should fix them by slowing money growth or by raising money growth?

Step by Step Answer: