Question: Suppose that your assistant has run a market-model regression for a company that produces sophisticated drilling machines, and finds the following results (t-statistic in parentheses):

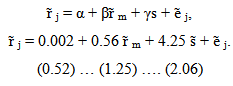

Suppose that your assistant has run a market-model regression for a company that produces sophisticated drilling machines, and finds the following results (t-statistic in parentheses):

Your assistant remarks that, as the estimated beta is insignificant, the true beta is zero. The exposure, in contrast, is significant, and must be equal to the estimated coefficient. How do you react?

fj= a+ m + ys + j, j = 0.002 + 0.56 m+ 4.25 + j. (0.52) ... (1.25) ... (2.06)

Step by Step Solution

3.44 Rating (157 Votes )

There are 3 Steps involved in it

You cannot simply conclude that 0 The low tstatistic says that on the basis of only the sample infor... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

1294-B-A-H-A(140).docx

120 KBs Word File