Question: Suppose you have the following historical returns for the stock market and for another company, P.Q. Unlimited. Explain how to calculate beta, and use the

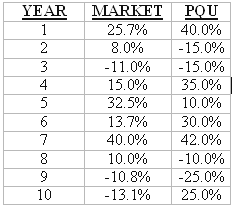

Suppose you have the following historical returns for the stock market and for another company, P.Q. Unlimited. Explain how to calculate beta, and use the historical stock returns to calculate the beta for PQU. Interpret your results.

YEAR MARKET PQU 25.7% 40.0% -15.0% 8.0% -11.0% 3 -15.0% 35.0% 10.0% 15.0% 32.5% 13.7% 30.0% 40.0% 42.0% 10.0% -10.0% -25.0% -10.8% 10 -13.1% 25.0%

Step by Step Solution

3.37 Rating (166 Votes )

There are 3 Steps involved in it

Betas are calculated as the slope of the characteristic line which is the regression line s... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

9-B-F-M-C (332).docx

120 KBs Word File