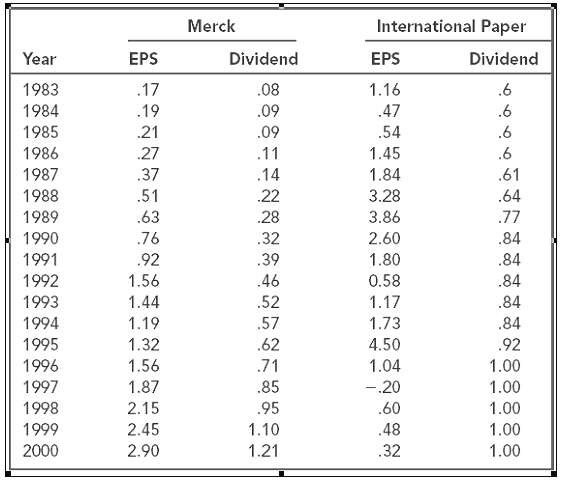

Question: Table 16.4 lists the dividends and earnings per share (EPS) for Merck and International Paper. Estimate the target payout for each company and the rate

Table 16.4 lists the dividends and earnings per share (EPS) for Merck and International Paper. Estimate the target payout for each company and the rate at which the dividend is adjusted toward the target. Suppose that in 2001 Merck?s earnings increase to $5 a share and International Paper?s earnings increase to $3 per share. How would you predict their dividends to change?

International Paper Merck Dividend Year EPS Dividend EPS 1983 .17 .08 1.16 .6 1984 .19 .09 .09 .47 .6 1985 .21 .54 .6 1986 .27 .11 1.45 .6 1987 .37 .14 1.84 .61 .51 .64 1988 .22 3.28 3.86 1989 .63 .28 .77 .84 1990 .76 .32 2.60 1991 .92 .39 1.80 .84 1992 1.56 .46 0.58 .84 1993 .52 1.17 .84 1.44 1994 1.73 .84 1.19 .57 .62 1995 1.32 4.50 .92 .71 1.00 1996 1.56 1.04 1997 1.87 .85 1.00 -.20 1998 2.15 .95 .60 1.00 .48 1999 2.45 1.10 1.00 2000 2.90 1.21 .32 1.00

Step by Step Solution

3.38 Rating (173 Votes )

There are 3 Steps involved in it

We make use of Lintners model suitably rearranged DIV t Adjustment Rate x Target ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

35-B-C-F-D-P (20).docx

120 KBs Word File