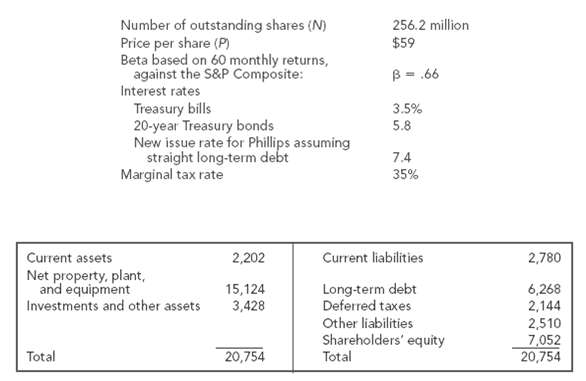

Question: Table 19.4 is a simplified book balance sheet for Phillips Petroleum in June 2001. Other information: (a) ? Calculate Phillips?s WACC. Use the capital asset

Table 19.4 is a simplified book balance sheet for Phillips Petroleum in June 2001. Other information:

(a)?Calculate Phillips?s WACC. Use the capital asset pricing model and the data given above. Make additional assumptions and approximations as necessary.

(b)?What would Phillips?s WACC be if it moved to and maintained a debt?market value ratio (D/V) of 25 percent?

Number of outstanding shares (N) Price per share (P) Beta based on 60 monthly returns, against the S&P Composite: Interest rates Treasury bills 20-year Treasury bonds New issue rate for Phillips assuming straight long-term debt Marginal tax rate 256.2 million $59 B = .66 3.5% 5.8 7.4 35% Current assets 2,202 Current liabilities 2,780 Net property, plant, and equipment Investments and other assets 15,124 3,428 Long-term debt Deferred taxes 6,268 2,144 2,510 7,052 20,754 Other liabilities Shareholders' equity Total Total 20,754

Step by Step Solution

3.40 Rating (178 Votes )

There are 3 Steps involved in it

a Assume that the expected future Treasurybill rate is equal to the 20year Treasury bon... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

35-B-C-F-D-P (72).docx

120 KBs Word File