Question: TAN Company has a defined benefit pension plan for its employees. The plan has been in existence for several years. During 2015, for the first

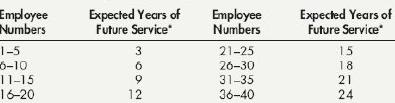

TAN Company has a defined benefit pension plan for its employees. The plan has been in existence for several years. During 2015, for the first time, TAN experienced a difference between its expected and actual projected benefit obligation. This resulted in a cumulative “experience” loss of $29,000 at the end of 2015, which it recorded and which did not change during 2016. TAN amortizes any excess loss by the straight-line method over the average remaining service life of its active participating employees. It has developed the following schedule concerning these 40 employee

*For Employee

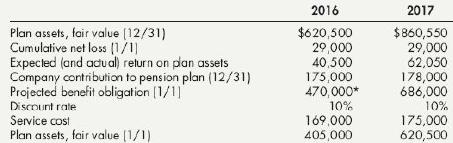

TAN makes its contribution to the pension plan at the end of each year. However, it has not always funded the entire pension expense in a given year. As a result, it had an accrued pension cost liability of $65,000 on December 31,2015.

In addition to the preceding information, the following set of facts for 2016 and 2017 has been assembled, based on information provided by TAN’s actuary and funding agency, and obtained from its accounting records:

*Includes the cumulative net loss at the end of 2015.

Required:

1. Calculate the average remaining service life of TAN’s employees. Compute to one decimal place.

2. Prepare a schedule to compute the net gain or loss component of pension expense for 2016 and 2017, assuming that the company uses the corridor approach. For simplicity, assume the average remaining life calculated in Requirement 1 is applicable to both years.

3. Prepare a schedule to compute the pension expense for 2016 and 2017.

4. Prepare all the journal entries related to TAN’s pension plan for 2016 and 2017.

5. What is TAN’s total accrued/prepaid pension cost at the end of 2016? Is it an asset or liability?

Employee Expected Years of Employee xpected Years of Numbers Future Service Numbers 21-25 26-30 31-35 36-40 Future Service 1-5 6-10 1-15 16-20 21 24 2016 2017 Plan assets, fair value [12/31) Cumulative net loss {1 / 1 1 Expecled plan assets Company contribution to pension plan (12/31) Projected benefit obligation 1/1] Discnunt rate Service cost Plan assets, fair value 1/1) $620,500 29,000 40,500 175,000 470,000* $860,550 29,000 62,050 178,000 686,000 and adual return on 10% 10% 169,000 405,000 175,000 620,500

Step by Step Solution

3.47 Rating (173 Votes )

There are 3 Steps involved in it

1 Straight line Method TAN Company computes the life of the 40 active contributing staff by using straight line method Total number of service years of all employees is 540 years The total number of e... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

524-B-A-I-T (1226).docx

120 KBs Word File