Question: Tanek Corp.s sales slumped badly in 2017. For the first time in its history, it operated at a loss. The companys income statement showed the

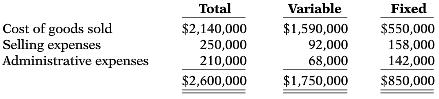

Tanek Corp.’s sales slumped badly in 2017. For the first time in its history, it operated at a loss. The company’s income statement showed the following results from selling 500,000 units of product: sales $2,500,000, total costs and expenses $2,600,000, and net loss $100,000. Costs and expenses consisted of the amounts shown below.

Management is considering the following independent alternatives for 2018.

1. Increase unit selling price 20% with no change in costs, expenses, and sales volume.

2. Change the compensation of salespersons from fixed annual salaries totaling $150,000 to total salaries of $60,000 plus a 5% commission on sales.

Instructions

(a) Compute the break-even point in dollars for 2017.

(b) Compute the break-even point in dollars under each of the alternative courses of action. (Round all ratios to nearest full percent.) Which course of action do you recommend?

Total Variable Fixed Cost of goods sold Selling expenses Administrative expenses $2,140,000 $1,590,000 $550,000 158,000 142,000 $1,750,000 $850,000 250,000 210,000 $2,600,000 92,000 68,000

Step by Step Solution

3.54 Rating (158 Votes )

There are 3 Steps involved in it

a Sales were 2500000 variable expenses were 1750000 70 of sales and fixed ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

426-B-M-A-C-V-P (1990).docx

120 KBs Word File