Question: Tartisan Resources Inc., a sporting goods retailer, recently completed its 2014 operations. Tartisan Resources Inc.s balance sheet information and income statement follow. Additional information regarding

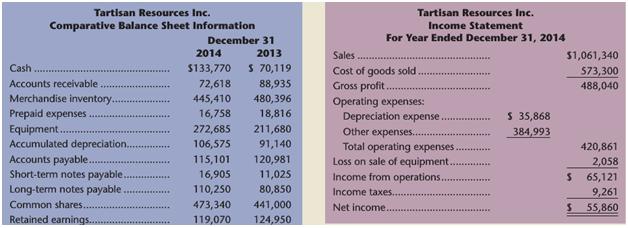

Tartisan Resources Inc., a sporting goods retailer, recently completed its 2014 operations. Tartisan Resources Inc.’s balance sheet information and income statement follow.

Additional information regarding Tartisan’s activities during 2014:

1. Loss on sale of equipment is $2,058.

2. Equipment costing $49,980 is sold for $27,489.

3. Equipment is purchased by paying cash of $37,485 and signing a long-term note payable for the balance.

4. Borrowed $5,880 by signing a short-term note payable.

5. Reduced a long-term note payable by making a payment.

6. Issued 2,940 common shares for cash at $11 per share.

7. Declared and paid cash dividends.

Required

Prepare a statement of cash flows for 2014 that reports the cash inflows and outflows from operating activities according to the indirect method. Show your supporting calculations. Also prepare a note describing non-cash investing and financing activities.

Analysis Component: Using the information from the statement of cash flows just prepared for Tartisan Resources Inc., identify the accrual basis net income and the cash basis net income for 2014. Explain why there is a difference between the twoamounts.

Tartisan Resources Inc. Tartisan Resources Inc. Comparative Balance Sheet Information Income Statement December 31 For Year Ended December 31, 2014 2014 2013 Sales $1,061,340 Cash $133,770 S 70,119 573,300 488,040 Cost of goods sold. Gross profit. Operating expenses: Depreciation expense ... .. Other expenses.. Total operating expenses . Loss on sale of equipment. Income from operations... Income taxes.. Accounts receivable Merchandise inventory. Prepaid expenses 72,618 88,935 480,396 18,816 445,410 16,758 S 35,868 Equipment.. Accumulated depreciation. Accounts payable. Short-term notes payable. Long-term notes payable 272,685 211,680 384,993 106,575 91,140 420,861 115,101 16,905 120,981 11,025 80,850 2,058 65,121 9,261 55,860 110,250 Common shares 473,340 441,000 Net income... Retained earnings. 124,950 119,070

Step by Step Solution

3.41 Rating (164 Votes )

There are 3 Steps involved in it

TARTISAN RESOURCES INC Statement of Cash Flows For Year Ended December 31 2014 Cash flows from opera... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

384-B-A-B-S-C-F (1193).docx

120 KBs Word File