Go back

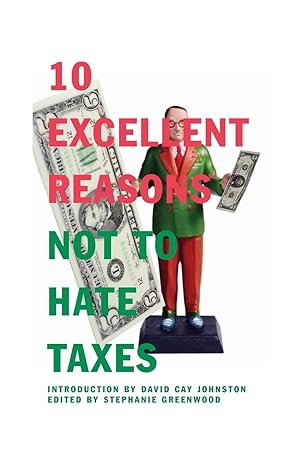

10 Excellent Reasons Not To Hate Taxes Introduction By David Cay Johnston Edited By Stephanie Greenwood(1st Edition)

Authors:

Stephanie Greenwood, David Cay Johnston

Cover Type:Hardcover

Condition:Used

In Stock

Include with your book

Free shipping: April 04, 2024Popular items with books

Access to 3 Million+ solutions

Free ✝

Ask 10 Questions from expert

200,000+ Expert answers

✝ 7 days-trial

Total Price:

$0

List Price: $13.95

Savings: $13.95(100%)

Book details

ISBN: 1595581618, 978-1595581617

Book publisher: The New Press (January 30, 2008)

Get your hands on the best-selling book 10 Excellent Reasons Not To Hate Taxes Introduction By David Cay Johnston Edited By Stephanie Greenwood 1st Edition for free. Feed your curiosity and let your imagination soar with the best stories coming out to you without hefty price tags. Browse SolutionInn to discover a treasure trove of fiction and non-fiction books where every page leads the reader to an undiscovered world. Start your literary adventure right away and also enjoy free shipping of these complimentary books to your door.

10 Excellent Reasons Not To Hate Taxes Introduction By David Cay Johnston Edited By Stephanie Greenwood 1st Edition Summary: Paying taxes. It's something almost everyone loves to hate. 10 Excellent Reasons Not to Hate Taxes makes the case for thinking about taxes in a fresh and progressive way and offers plenty of material for anyone interested in countering the conservative anti-government, anti-tax agenda.Written by activists, economists, teachers, political scientists, and business people, 10 Excellent Reasons Not to Hate Taxes offers an array of powerful arguments that will reframe the tax debate. Chapters on the effect of taxes on the economy, education, the environment, and the distribution of opportunity will arm readers with a wealth of arguments to turn the tables when thinking?or arguing?about taxes and provide a menu of ideas for how to transform the tax code into a tool for social justice.With a January publication date, just when the tax preparation books and software flood the stores, this book will spark a lively and much-needed debate about all manner of tax issues, from the inheritance tax and flat taxes to tax cuts and the role that taxes play in the growing economic divide in the United States.

Customers also bought these books

Frequently Bought Together

Top Reviews for Books

Hagos T.

( 5 )

"Delivery was considerably fast, and the book I received was in a good condition."