Go back

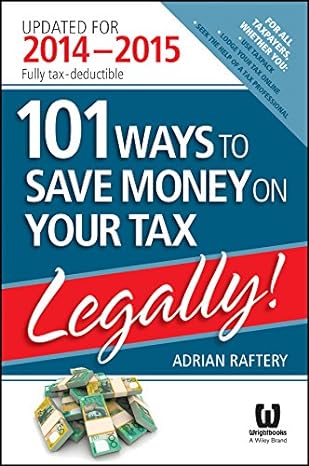

101 Ways To Save Money On Your Tax Legally 2014-2015(4th Edition)

Authors:

Adrian Raftery

Cover Type:Hardcover

Condition:Used

In Stock

Include with your book

Free shipping: April 30, 2024Popular items with books

Access to 3 Million+ solutions

Free ✝

Ask 10 Questions from expert

200,000+ Expert answers

✝ 7 days-trial

Total Price:

$0

List Price: $21.95

Savings: $21.95(100%)

Book details

ISBN: 073031037X, 978-0730310372

Book publisher: Wiley

Get your hands on the best-selling book 101 Ways To Save Money On Your Tax Legally 2014-2015 4th Edition for free. Feed your curiosity and let your imagination soar with the best stories coming out to you without hefty price tags. Browse SolutionInn to discover a treasure trove of fiction and non-fiction books where every page leads the reader to an undiscovered world. Start your literary adventure right away and also enjoy free shipping of these complimentary books to your door.