Go back

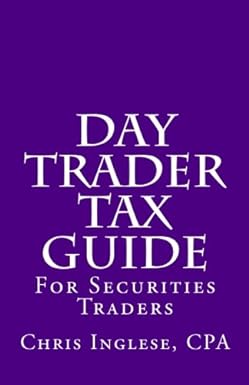

Day Trader Tax Guide For Securities Traders(1st Edition)

Authors:

Chris Inglese CPA

Cover Type:Hardcover

Condition:Used

In Stock

Include with your book

Free shipping: April 04, 2024Popular items with books

Access to 3 Million+ solutions

Free ✝

Ask 10 Questions from expert

200,000+ Expert answers

✝ 7 days-trial

Total Price:

$0

List Price: $9.95

Savings: $9.95(100%)

Book details

ISBN: 1478174447, 978-1478174448

Book publisher: CreateSpace Independent Publishing Platform (July 23, 2012)

Get your hands on the best-selling book Day Trader Tax Guide For Securities Traders 1st Edition for free. Feed your curiosity and let your imagination soar with the best stories coming out to you without hefty price tags. Browse SolutionInn to discover a treasure trove of fiction and non-fiction books where every page leads the reader to an undiscovered world. Start your literary adventure right away and also enjoy free shipping of these complimentary books to your door.

Day Trader Tax Guide For Securities Traders 1st Edition Summary: Day traders must comply with a set of unique and complex tax rules. Many traders are paying too much tax and don't even know it. They make a mistake by relying solely on their tax preparer to properly comply with the tax rules and to provide them with tax-saving advice. This booklet is intended to inform the one-person day trader, who actively and materially participates in a securities trading activity. It generally explains the "mark to market" tax election (the most valuable tax-saving election available to day traders). It then compares the tax rules applicable to the regular day trader, with those which apply to the day trader who has made such an election. Day traders are ultimately responsible for the taxes they pay. Many unfortunately pay thousands of dollars in unnecessary taxes each year. Don't be one of them.

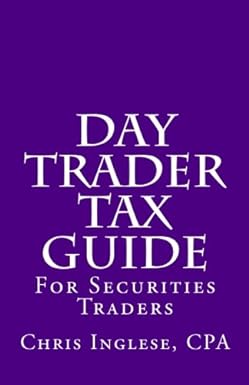

Customers also bought these books

Frequently Bought Together

Top Reviews for Books

ROTIMI OYEKANMI

( 5 )

"Delivery was considerably fast, and the book I received was in a good condition."