Go back

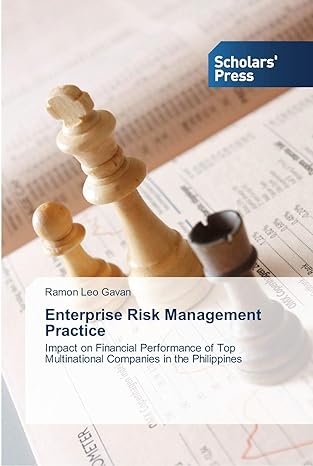

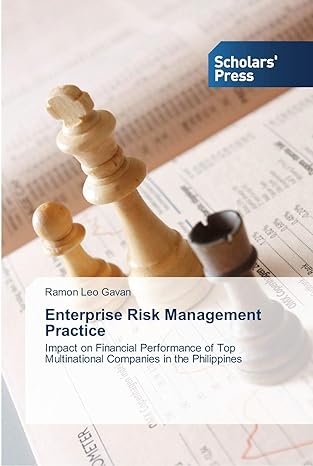

Enterprise Risk Management Practice Impact On Financial Performance Of Top Multinational Companies In The Philippines(1st Edition)

Authors:

Ramon Leo Gavan

Cover Type:Hardcover

Condition:Used

In Stock

Include with your book

Free shipping: April 04, 2024Popular items with books

Access to 3 Million+ solutions

Free ✝

Ask 10 Questions from expert

200,000+ Expert answers

✝ 7 days-trial

Total Price:

$0

List Price: $103.00

Savings: $103(100%)

Book details

ISBN: 3639510046, 978-3639510041

Book publisher: Scholar's Press

Get your hands on the best-selling book Enterprise Risk Management Practice Impact On Financial Performance Of Top Multinational Companies In The Philippines 1st Edition for free. Feed your curiosity and let your imagination soar with the best stories coming out to you without hefty price tags. Browse SolutionInn to discover a treasure trove of fiction and non-fiction books where every page leads the reader to an undiscovered world. Start your literary adventure right away and also enjoy free shipping of these complimentary books to your door.

Enterprise Risk Management Practice Impact On Financial Performance Of Top Multinational Companies In The Philippines 1st Edition Summary: Over the last decade, largely because of the profound events of 2007-2009, there has been an increasing consciousness in risk literature that a more holistic approach to managing risks would enrich the effectiveness of risk management practices across industries. Despite the heightened interest in enterprise risk management (ERM) by academics and practitioners, there is an absence of empirical evidence on the impact of various ERM practices on the three most commonly used financial performance ratios: return on total assets, net profit margin and return on equity. The absence of clear empirical evidence on the value of ERM and the effects of the level of ERM practices on financial performance continues to limit the growth of these programs. This book, therefore, provides a new metric of success for enterprise risk management, in assessing and managing uncertainties that various enterprises face as value is being generated. The analysis should help shed some light on whether the use of a fully functioning ERM helps big companies enhance their financial performance, and should be especially useful to the top executives in making decisions towards adopting ERM within their firms.

Customers also bought these books

Frequently Bought Together

Top Reviews for Books

Judy Amos

( 4 )

"Delivery was considerably fast, and the book I received was in a good condition."