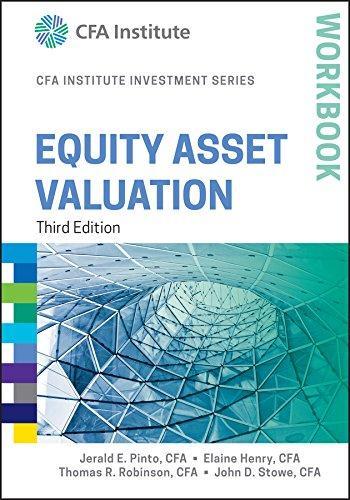

Equity Asset Valuation Workbook(2nd Edition)

Authors:

Jerald E. Pinto, Elaine Henry, Thomas R. Robinson, John D. Stowe

Type:Hardcover/ PaperBack / Loose Leaf

Condition: Used/New

In Stock: 2 Left

Shipment time

Expected shipping within 2 - 3 DaysPopular items with books

Access to 35 Million+ Textbooks solutions

Free ✝

Ask Unlimited Questions from expert

AI-Powered Answers

30 Min Free Tutoring Session

✝ 7 days-trial

Total Price:

$0

List Price: $1.97

Savings: $1.97

(100%)

Solution Manual Includes

Access to 30 Million+ solutions

Ask 50 Questions from expert

AI-Powered Answers

24/7 Tutor Help

Detailed solutions for Equity Asset Valuation Workbook

Price:

$9.99

/month

Book details

ISBN: 0470395214, 978-0470395219

Book publisher: Wiley

Customers also bought these books (18)

Popular Among Students (15)

Customer Reviews

Trusted feedback from verified buyers

HB

The workbook serves as a decent introduction to equity asset valuation, but I found some of the problems a bit simplistic, especially if you already have some background in finance. The delivery was smooth and it came well-packaged. Would love more challenging questions in the next edition.

RS

This workbook strikes a great balance between theoretical concepts and practical applications. I especially liked the exercises that helped cement my understanding of the valuation methods. The only downside is a few typos here and there, but nothing overly distracting. Got an extra discount with my bookstore membership, which made it even more appealing.

SN

This workbook is a goldmine of practical exercises and scenarios that truly bring the principles of equity valuation to life. As someone who is taking the CFA exams, the detailed examples have been incredibly helpful for understanding complex concepts. The book arrived quickly and was in perfect condition. I also appreciated the extra discount I got with my Prime membership!

DS

Equity Asset Valuation Workbook, 2nd Edition, is a must-have for anyone serious about understanding finance. The explanations are clear, and the exercises challenge you to apply what you've learned in meaningful ways. I found the section on discounted cash flow valuation particularly insightful. It was well-packaged and delivered faster than I expected. Worth every penny!