Go back

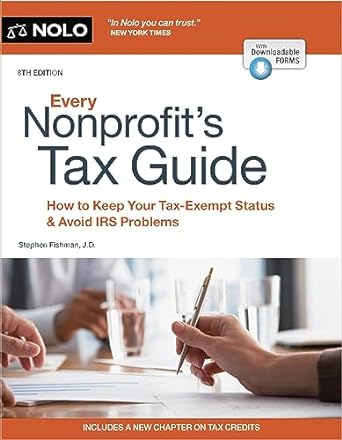

Every Nonprofits Tax Guide How To Keep Your Tax Exempt Status And Avoid IRS Problems(8th Edition)

Authors:

Stephen Fishman J.d. Edition

Cover Type:Hardcover

Condition:Used

In Stock

Include with your book

Free shipping: April 04, 2024Popular items with books

Access to 3 Million+ solutions

Free ✝

Ask 10 Questions from expert

200,000+ Expert answers

✝ 7 days-trial

Total Price:

$0

List Price: $30.16

Savings: $30.16(100%)

Book details

ISBN: 1413331157, 978-1413331158

Book publisher: NOLO

Get your hands on the best-selling book Every Nonprofits Tax Guide How To Keep Your Tax Exempt Status And Avoid IRS Problems 8th Edition for free. Feed your curiosity and let your imagination soar with the best stories coming out to you without hefty price tags. Browse SolutionInn to discover a treasure trove of fiction and non-fiction books where every page leads the reader to an undiscovered world. Start your literary adventure right away and also enjoy free shipping of these complimentary books to your door.

Every Nonprofits Tax Guide How To Keep Your Tax Exempt Status And Avoid IRS Problems 8th Edition Summary: The essential tax reference book for every nonprofitNonprofits enjoy privileges not available to other organizations. But these privileges come with obligations: Nonprofits must comply with special IRS rules and regulations to maintain their tax-exempt status.Practical, comprehensive, and easy to understand, Every Nonprofit’s Tax Guide explains ongoing and annual IRS compliance requirements for nonprofits, including:• a detailed explanation of Form 990• requirements for filing Form 990-EZ electronically• how to file Form 1099-NEC• conflicts of interest and compensation rules• charitable giving rules• unrelated taxable business income rules• lobbying and political activity restrictions, and• nonprofit bookkeeping.Whether you are just starting your nonprofit or are well established, you’ll find all the information you need to avoid the most common issues nonprofits run into with the IRS.

Customers also bought these books

Frequently Bought Together

Top Reviews for Books

Matt Ciccone

( 4 )

"Delivery was considerably fast, and the book I received was in a good condition."