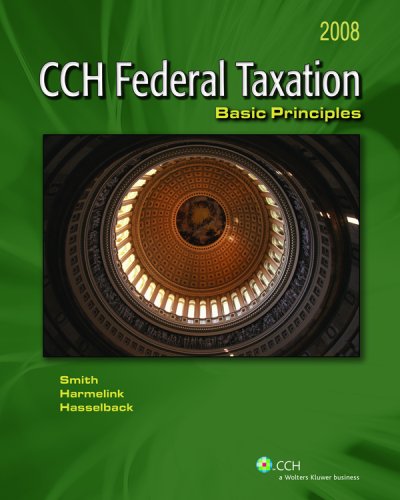

Federal Taxation Basic Principles(2008th Edition)

Authors:

Ephraim P Smith

Type:Hardcover/ PaperBack / Loose Leaf

Condition: Used/New

In Stock: 1 Left

Shipment time

Expected shipping within 2 - 3 DaysPopular items with books

Access to 35 Million+ Textbooks solutions

Free ✝

Ask Unlimited Questions from expert

AI-Powered Answers

30 Min Free Tutoring Session

✝ 7 days-trial

Total Price:

$0

List Price: $42.00

Savings: $42

(100%)

Solution Manual Includes

Access to 30 Million+ solutions

Ask 50 Questions from expert

AI-Powered Answers

24/7 Tutor Help

Detailed solutions for Federal Taxation Basic Principles

Price:

$9.99

/month

Book details

ISBN: 0808016695, 978-0808016694

Book publisher: CCH, Inc.