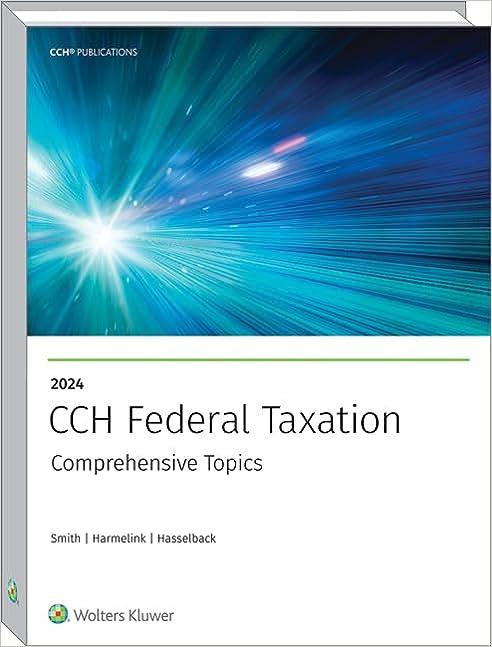

Federal Taxation Basic Principles 2023(2023 Edition)

Authors:

Ephraim P. Smith, Philip J. Harmelink, James R. Hasselback

Type:Hardcover/ PaperBack / Loose Leaf

Condition: Used/New

In Stock: 1 Left

Shipment time

Expected shipping within 2 - 3 DaysPopular items with books

Access to 35 Million+ Textbooks solutions

Free ✝

Ask Unlimited Questions from expert

AI-Powered Answers

30 Min Free Tutoring Session

✝ 7 days-trial

Total Price:

$101.9

List Price: $145.57

Savings: $43.67

(30%)

Solution Manual Includes

Access to 30 Million+ solutions

Ask 50 Questions from expert

AI-Powered Answers

24/7 Tutor Help

Detailed solutions for Federal Taxation Basic Principles 2023

Price:

$9.99

/month

Book details

ISBN: 0808057227, 978-0808057222

Book publisher: CCH Inc, Wolters Kluwer Limited

Book Price $101.9 : Title: Federal Taxation Basic Principles 2023 by Ephraim P. Smith, Philip J. Harmelink, and James R. Hasselback provides a comprehensive exploration into the intricacies of U.S. federal tax laws, regulations, and principles, focusing on both individuals and businesses. The book is an essential resource for anyone interested in learning how these tax laws apply in real-world scenarios. It covers critical issues such as income recognition, tax deductions, credits, and property transactions. Unlike a novel, Federal Taxation Basic Principles 2023 does not have a plot or characters but serves as a vital tool for tax professionals and students alike. Key concepts such as deductibility, recognition of gain or loss, and the nuances of tax credits are explained in detail, providing invaluable guidance for both practitioners and learners. The book incorporates a clear and structured table of content that guides readers through complex topics step-by-step, making it particularly useful for study and application. Additionally, it comes with a solution manual and answer key which helps students practice and evaluate their understanding of various tax scenarios. The reception of this publication has been positive, with professionals praising its detailed treatment of federal tax principles and its utility as a reliable reference. Learning Style Implementation (LSI) context: Key segments discuss the methodology by which taxpayers can optimize their liability through understanding deductions and credits, adding depth to this knowledge base are end-of-chapter exercises that reinforce learning. Courses are designed around this material to strengthen comprehension across various fundamentals of taxation. The author's cheap approach ensures that complex theories become accessible to everyone.

Customers also bought these books (18)

Popular Among Students (16)

Customer Reviews

Trusted feedback from verified buyers

AJ

Needed this book for my course ACCT 3050: Fundamentals of Federal Taxation and picked it up on a discount so that was nice. The package showed up faster than I thought it would which was cool since I have a bunch of reading soon. Haven't cracked it all open yet but the text looks clean and not too overwhelming so that’s promising. Pages feel solid too which sometimes matters for how I mark up books in class. For the price I paid with the discount, not bad, but I’m still waiting to see how well it really helps in practice.

NG

If you're diving into federal taxation, this book is worth every penny. The examples are explained with such clarity that complex topics become easy to grasp. I plan to keep this on my shelf as a go-to reference. The book arrived on time and in excellent condition. Definitely a five-star read!

BC

Federal Taxation Basic Principles 2023 is an outstanding resource. It's written in clear, concise language that's easy to understand. The examples included are relevant and practical, which is immensely helpful for both students and tax professionals. I also appreciated the prompt delivery; received it within two days and in perfect condition. Cannot recommend this book enough!

SP

Decent introduction to federal taxation, but some sections felt a bit bare. Helpful with the basics though!

HA

This book provides a comprehensive overview of federal taxation principles. The text is informative with a good balance of theory and practice; however, I occasionally found myself wanting a bit more depth on certain topics. Got an extra discount with my membership, which was a bonus! Arrived quickly and was well-packaged.