Go back

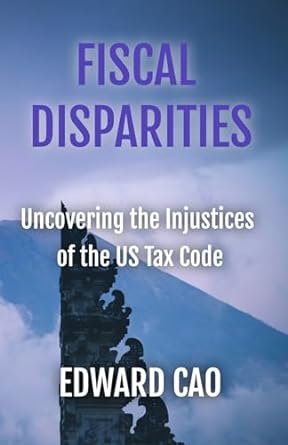

Fiscal Disparities Uncovering The Injustices Of The US Tax Code(1st Edition)

Authors:

Edward Cao

Cover Type:Hardcover

Condition:Used

In Stock

Include with your book

Free shipping: April 03, 2024Popular items with books

Access to 3 Million+ solutions

Free ✝

Ask 10 Questions from expert

200,000+ Expert answers

✝ 7 days-trial

Total Price:

$0

List Price: $4.99

Savings: $4.99(100%)

Book details

ISBN: 979-8862406733

Book publisher: Independently published

Get your hands on the best-selling book Fiscal Disparities Uncovering The Injustices Of The US Tax Code 1st Edition for free. Feed your curiosity and let your imagination soar with the best stories coming out to you without hefty price tags. Browse SolutionInn to discover a treasure trove of fiction and non-fiction books where every page leads the reader to an undiscovered world. Start your literary adventure right away and also enjoy free shipping of these complimentary books to your door.

Fiscal Disparities Uncovering The Injustices Of The US Tax Code 1st Edition Summary: It sometimes takes a national crisis to bring to light major shortcomings in our national structure, and the pandemic did this with regards to wealth inequality, exasperating it to inconceivable levels. There are many factors that contribute to this economic divide including a high cost of living and stagnant wages, but at the heart of wealth inequality is the issue of taxes. Taxes remain one of the most overlooked topics when it comes to social mobility and equality. They are the driving forces of our government, funding essential services and basic needs for all citizens. In an idealized tax system, the rich would pay a greater percentage of their wealth to taxes and the poor would pay less. However, the US’s tax code is set up specifically to benefit the rich, who are the single greatest influence in our government. Changing that first requires an understanding of the different inequalities in place.

Customers also bought these books

Frequently Bought Together

Top Reviews for Books

Request da3tumt

( 4 )

"Delivery was considerably fast, and the book I received was in a good condition."