Go back

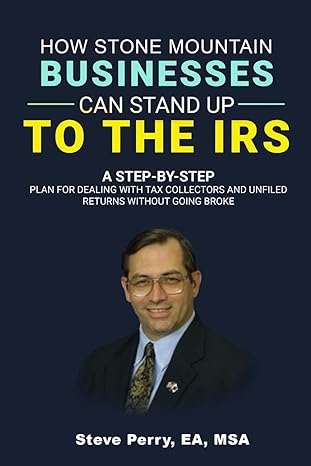

How Stone Mountain Businesses Can Stand Up To The Irs A Step By Step Plan For Dealing With Tax Collectors And Unfiled Returns Without Going Broke(1st Edition)

Authors:

Steve Perry

Cover Type:Hardcover

Condition:Used

In Stock

Include with your book

Free shipping: April 04, 2024Popular items with books

Access to 3 Million+ solutions

Free ✝

Ask 10 Questions from expert

200,000+ Expert answers

✝ 7 days-trial

Total Price:

$0

List Price: $9.95

Savings: $9.95(100%)

Book details

ISBN: 979-8863314594

Book publisher: Independently published

Get your hands on the best-selling book How Stone Mountain Businesses Can Stand Up To The Irs A Step By Step Plan For Dealing With Tax Collectors And Unfiled Returns Without Going Broke 1st Edition for free. Feed your curiosity and let your imagination soar with the best stories coming out to you without hefty price tags. Browse SolutionInn to discover a treasure trove of fiction and non-fiction books where every page leads the reader to an undiscovered world. Start your literary adventure right away and also enjoy free shipping of these complimentary books to your door.

How Stone Mountain Businesses Can Stand Up To The Irs A Step By Step Plan For Dealing With Tax Collectors And Unfiled Returns Without Going Broke 1st Edition Summary: This book pulls back the curtain on IRS encounters. We have all either heard or experienced the terrifying experience of interacting with the IRS. Very few people actively try to defraud the IRS. For most people in the IRS's crosshairs, the problems came from life getting in the way, whether family illness or economic problems or bad advice, the vast majority of people want to pay their taxes and be left alone. This book is for those who want to understand what needs to happen when the IRS comes calling. In most cases, professional help is needed. This book will help you determine when and what kind of help to use and what questions to ask and finally when the amount owed just isn't worth the fight. This book is a must read for anyone who owns a business or has a tax return more complex than a simple W-2 return.

Customers also bought these books

Frequently Bought Together

Top Reviews for Books

Monika Parikh

( 4 )

"Delivery was considerably fast, and the book I received was in a good condition."