Go back

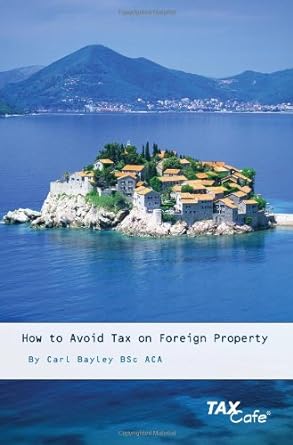

How To Avoid Tax On Foreign Property(1st Edition)

Authors:

Carl Bayley

Cover Type:Hardcover

Condition:Used

In Stock

Include with your book

Free shipping: April 04, 2024Popular items with books

Access to 3 Million+ solutions

Free ✝

Ask 10 Questions from expert

200,000+ Expert answers

✝ 7 days-trial

Total Price:

$0

List Price: $17.12

Savings: $17.12(100%)

Book details

ISBN: 1904608663, 978-1904608660

Book publisher: Taxcafe Uk Ltd

Get your hands on the best-selling book How To Avoid Tax On Foreign Property 1st Edition for free. Feed your curiosity and let your imagination soar with the best stories coming out to you without hefty price tags. Browse SolutionInn to discover a treasure trove of fiction and non-fiction books where every page leads the reader to an undiscovered world. Start your literary adventure right away and also enjoy free shipping of these complimentary books to your door.

How To Avoid Tax On Foreign Property 1st Edition Summary: This unique new book tells you everything you need to know about paying less tax on foreign property. Whether you're buying a dream holiday home or building an overseas property empire, this guide will steer you towards handsome tax savings. Subjects covered include how to pay less tax on foreign rental income both in the UK and abroad, how to avoid capital gains tax on overseas property, how to get the taxman to pay for your overseas trips, including flights, hotels and meals, how to recover VAT at up to 25% on overseas property purchases, the benefits and dangers of using a company to buy foreign property, how to avoid foreign inheritance tax and wealth tax, how to protect your property from foreign succession laws, how to get tax relief for foreign currency losses and how double tax agreements work and what can they do for YOU. Detailed chapters outlining the property tax systems in some of the most popular destinations including France, Spain, Bulgaria, Italy, Portugal, Cyprus and Dubai.

Customers also bought these books

Frequently Bought Together

Top Reviews for Books

Onieka Heywood

( 5 )

"Delivery was considerably fast, and the book I received was in a good condition."