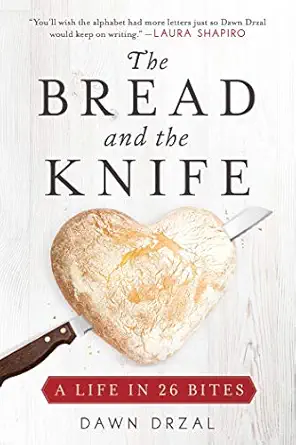

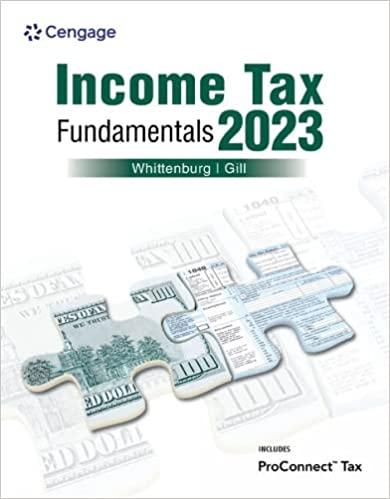

Income Tax Fundamentals 2018(36th Edition)

Authors:

Gerald E. Whittenburg, Steven Gill

Type:Hardcover/ PaperBack / Loose Leaf

Condition: Used/New

In Stock: 2 Left

Shipment time

Expected shipping within 2 - 3 DaysPopular items with books

Access to 35 Million+ Textbooks solutions

Free ✝

Ask Unlimited Questions from expert

AI-Powered Answers

30 Min Free Tutoring Session

✝ 7 days-trial

Total Price:

$0

List Price: $6.81

Savings: $6.81

(100%)

Solution Manual Includes

Access to 30 Million+ solutions

Ask 50 Questions from expert

AI-Powered Answers

24/7 Tutor Help

Detailed solutions for Income Tax Fundamentals 2018

Price:

$9.99

/month

Book details

ISBN: 1337588350, 978-1337588355

Book publisher: Cengage Learning; 36th Edition (December 6, 2017)

Offer Just for You!:

Buy 2 books before the end of January and enter our lucky draw.

Book Price $0 : Income Tax Fundamentals 2018 by Gerald E. Whittenburg and Steven Gill is an essential resource for understanding the complexities of federal income tax in the United States. The book provides a detailed exploration of tax procedures, regulations, and computations, making it a valuable tool for students and practitioners alike. It covers the fundamental concepts of income tax, including filing requirements, income exclusion, deductions, tax credits, and the intricacies of capital gains and losses. The solution manual included offers a step-by-step approach to solving common tax problems, which is crucial for grasping practical applications of theoretical knowledge. An answer key is provided to assist students in verifying their solutions, ensuring a comprehensive understanding of tax codes. The table of content is meticulously organized, allowing easy navigation through topics like gross income calculation, standard deductions, and the filing of various schedules and forms. The book has been well-received for its clear explanations and practical examples, aiding users in applying tax laws to real-world scenarios. It serves not only as a textbook for tax courses but also as a reference guide for tax professionals. Incorporating updates from the latest tax reforms, this edition remains relevant amidst ongoing changes in tax legislation. With its cheap price point, this manual is tailored to meet the needs of cost-sensitive learners.

Customers also bought these books

Popular Among Students

Customer Reviews

Trusted feedback from verified buyers

PS

Income Tax Fundamentals 2018, 36th Edition is an outstanding book for anyone looking to understand tax concepts. The explanations are clear and the examples are practical, making it easier for beginners to grasp challenging topics. As a finance student, I've found it particularly helpful for my coursework. Also, kudos to the seller, the book arrived earlier than expected, and was in pristine condition. I did get an extra discount using my textbook subscription, which was a nice bonus. Overall, this book is a must-have if you're serious about mastering taxation fundamentals!