Go back

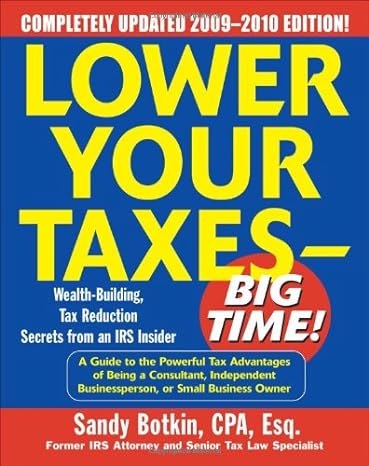

Lower Your Taxes Big Time 2009-2010(2009 Edition)

Authors:

Sandy Botkin

Cover Type:Hardcover

Condition:Used

In Stock

Include with your book

Free shipping: April 04, 2024Popular items with books

Access to 3 Million+ solutions

Free ✝

Ask 10 Questions from expert

200,000+ Expert answers

✝ 7 days-trial

Total Price:

$0

List Price: $71.00

Savings: $71(100%)

Book details

ISBN: 0071623787, 978-0071623780

Book publisher: McGraw-Hill

Get your hands on the best-selling book Lower Your Taxes Big Time 2009-2010 2009 Edition for free. Feed your curiosity and let your imagination soar with the best stories coming out to you without hefty price tags. Browse SolutionInn to discover a treasure trove of fiction and non-fiction books where every page leads the reader to an undiscovered world. Start your literary adventure right away and also enjoy free shipping of these complimentary books to your door.

Lower Your Taxes Big Time 2009-2010 2009 Edition Summary: "Almost every American can get a raise of $3,000-$15,000 or more annually courtesy of the United States Government." -David D'Arcangelo, author of Wealth Starts at Home"Will put thousands of dollars in your pocket every year and teach you, in clear simple steps, how to audit proof your records from the IRS forever." -Mark Victor Hansen, co-creator, #1 New York Times best-selling series Chicken Soup for the Soul®The classic tax-relief guide--updated to help you save more than ever!The amount Americans pay in taxes exceeds all other expenses combined. And with the economic downturn taking its toll on small businesses around the country, taxes are a greater financial burden than ever before. Lower Your Taxes-Big Time, 2009-2010 shows consultants, business owners, and contractors how to slash their tax bills by thousands. Written by Sandy Botkin, CPA and former attorney for the IRS, this informative and engaging book explains how toGet a yearly subsidy of $5,000 or more back from the IRS Properly document your business deductions Avoid any future audits by the IRS Deduct the equivalent of your child's education, braces, or wedding Take advantage of tax-free fringe benefits available to small businesses

Customers also bought these books

Frequently Bought Together

Top Reviews for Books

Request 6mxf2pr

( 5 )

"Delivery was considerably fast, and the book I received was in a good condition."