Go back

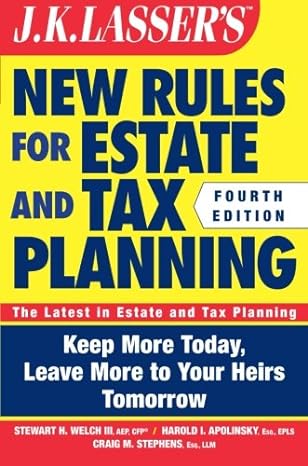

New Rules For Estate And Tax Planning The Least In Estate And Tax Planning(4th Edition)

Authors:

Stewart H. Welch

Cover Type:Hardcover

Condition:Used

In Stock

Include with your book

Free shipping: April 04, 2024Popular items with books

Access to 3 Million+ solutions

Free ✝

Ask 10 Questions from expert

200,000+ Expert answers

✝ 7 days-trial

Total Price:

$0

List Price: $4.95

Savings: $4.95(100%)

Book details

ISBN: 1118113551, 978-1118113554

Book publisher: Wiley

Get your hands on the best-selling book New Rules For Estate And Tax Planning The Least In Estate And Tax Planning 4th Edition for free. Feed your curiosity and let your imagination soar with the best stories coming out to you without hefty price tags. Browse SolutionInn to discover a treasure trove of fiction and non-fiction books where every page leads the reader to an undiscovered world. Start your literary adventure right away and also enjoy free shipping of these complimentary books to your door.

New Rules For Estate And Tax Planning The Least In Estate And Tax Planning 4th Edition Summary: A complete guide to planning an estate under today's tax rulesWhen it comes to an estate (no matter how big or small it may be) nothing should be left to chance. Proper planning is necessary to protect both your assets and your heirs. Estate Planning Law Specialists Harold Apolinsky and Craig Stephens and expert financial planner Stewart Welch III know this better than anyone else, and in the revised and updated edition of J.K. Lasser's New Rules for Estate and Tax Planning, they offer valuable advice and solid strategies to help you plan your estate under today's tax rules as well as preserve your wealth.Packed with up-to-the-minute facts, this practical resource covers a wealth of important issues.Reveals how new legislation will impact inheritances and trusts and offers guidance for estate and generation-skipping tax planningExplains the role of wills, executors, and trusts and shows how to treat charitable contributionsOutlines the do's and don'ts of gifting and explains life insurance and retirement planningFilled with in-depth insights and expert advice, this book will show how to efficiently arrange your estate today so that you can leave more to those you care about tomorrow.

Customers also bought these books

Frequently Bought Together

Top Reviews for Books

Keith lebanowski

( 4 )

"Delivery was considerably fast, and the book I received was in a good condition."