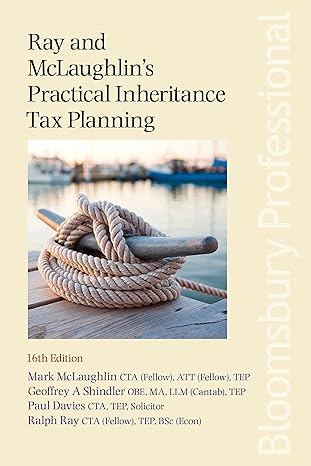

Practical Inheritance Tax Planning(1st Edition)

Authors:

Mr Alan Pink FCA CTA

Type:Hardcover/ PaperBack / Loose Leaf

Condition: Used/New

In Stock: 1 Left

Shipment time

Expected shipping within 2 - 3 DaysPopular items with books

Access to 35 Million+ Textbooks solutions

Free ✝

Ask Unlimited Questions from expert

AI-Powered Answers

30 Min Free Tutoring Session

✝ 7 days-trial

Total Price:

$0

List Price: $15.00

Savings: $15

(100%)

Solution Manual Includes

Access to 30 Million+ solutions

Ask 50 Questions from expert

AI-Powered Answers

24/7 Tutor Help

Detailed solutions for Practical Inheritance Tax Planning

Price:

$9.99

/month

Book details

ISBN: 1916356664, 978-1916356665

Book publisher: Pink Proactive Publishing LLP

Customers also bought these books (18)

Popular Among Students (17)

Customer Reviews

Trusted feedback from verified buyers

AP

As a beginner in estate planning, this book served as a decent introduction. However, I felt it lacked the depth I was hoping for, especially on the topic of international inheritance tax laws. Nevertheless, it's a good starting point for basic concepts and quick reference.

CK

Ordered this with high hopes and wasn’t disappointed. The book strikes a pretty good balance between theory and practical application, which is crucial for strategic planning. Got it with my library membership discount. My only gripe is that it leans a bit towards complex terminologies without further simplification at times. Delivery was punctual.

EW

Outstanding book! It offers a detailed exploration of inheritance tax planning, covering every angle one might need. The strategies discussed are practical and clearly explained, making it easier for professionals and novices alike. I got an extra discount with my subscription, which was a nice bonus. Arrived in perfect condition. Couldn't ask for more!

LP

This book is definitely a solid choice for anyone dealing with estate matters. The language is straightforward, making it easy to grasp the essentials of inheritance tax. The only drawback is that it could use a few more recent case studies. But overall, it's a valuable addition to my collection. Came faster than expected!

KT

This book truly stands out as a comprehensive guide. The author breaks down complex inheritance tax concepts into understandable chunks. As someone who's relatively new to tax planning, I found the examples particularly helpful and realistic. I received the book promptly, and it was well-packaged. Highly recommended for anyone looking to navigate inheritance tax effectively!