Go back

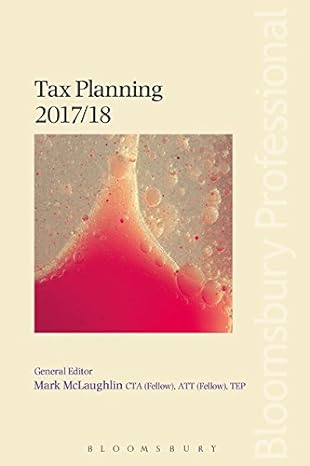

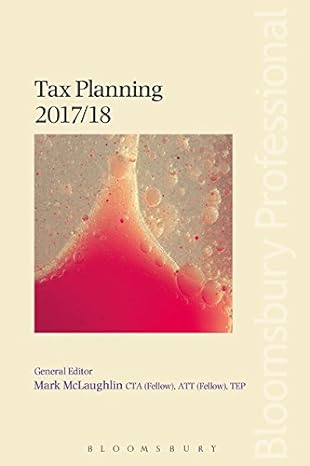

Tax Planning(2018 Edition)

Authors:

Mark McLaughlin

Cover Type:Hardcover

Condition:Used

In Stock

Include with your book

Free shipping: April 04, 2024Popular items with books

Access to 3 Million+ solutions

Free ✝

Ask 10 Questions from expert

200,000+ Expert answers

✝ 7 days-trial

Total Price:

$0

List Price: $53.10

Savings: $53.1(100%)

Book details

ISBN: 152650166X, 978-1526501660

Book publisher: Bloomsbury Professional

Get your hands on the best-selling book Tax Planning 2018 Edition for free. Feed your curiosity and let your imagination soar with the best stories coming out to you without hefty price tags. Browse SolutionInn to discover a treasure trove of fiction and non-fiction books where every page leads the reader to an undiscovered world. Start your literary adventure right away and also enjoy free shipping of these complimentary books to your door.

Tax Planning 2018 Edition Summary: New planning strategies and tax saving opportunities Tax Planning 2017/18 covers new planning strategies and tax saving opportunities and the many situations and tax planning opportunities that practitioners encounter everyday when dealing with their clients' tax affairs.Written by some of the UK's leading tax specialists and experienced authors, this book clearly and concisely explains key tax planning ideas and concepts and is fully updated to the latest Finance Act. This book is full of easily implementable technical suggestions and advice. It outlines the planning opportunities and potential pitfalls concerning specific transactions and circumstances and demonstrates how to successfully organise and structure the finances of individuals, trusts, and unincorporated businesses and companies. Practical and user-friendly, it contains worked examples throughout, and the short paragraphs and bullet-point style will help you to locate the information you need quickly and efficiently. This tax planning title concentrates on key areas of tax planning which are of greater relevance to the tax practitioner on a day-to-day basis.

Customers also bought these books

Frequently Bought Together

Top Reviews for Books

Fahad Abdullah

( 5 )

"Delivery was considerably fast, and the book I received was in a good condition."